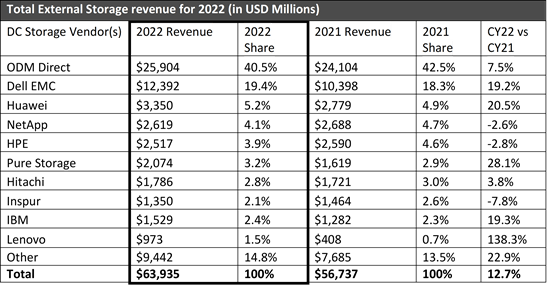

According to the Omdia Data Center (DC) storage tracker, total revenue for DC storage systems grew 12.7% year-over-year (YoY) to $63.9 billion in 2022 and saw revenue hit $16.6 billion, a 4.1% YoY increase during the fourth quarter (4Q22)

Towards the end of 2022, Omdia saw a shift in the storage market from being cloud led to being enterprise buyer led. Cloud service provider (SP) purchasing slowed in the third and fourth quarters, impacting the revenue growth of their primary vendors, ODM Direct, as shown in the chart below.

2022 was a comeback year for enterprise investment in storage, following two years of spending restraint and a shift towards cloud usage brought about by the COVID-19 pandemic. This resulted in significant uptick in demand for traditional storage systems which positively impacted vendors like Dell, HPE and Pure Storage. During 2022, Omdia research sensed an increase in modernizations to somewhat neglected on-premises DCs, and a ramp up in cloud repatriation actions. This feedback is aligned with a broad IT trend we’ve already observed – IT organizations stepping back to rationalize their cloud vs. on-premises spend, and optimally reposition apps and data.

Revenue generated by ODM Direct from shipping white box storage (aka dense storage-servers and server expansion) to mostly hyperscale cloud service providers grew by 7.5% YoY in 2022 to $25.9 billion. Storage shipped by enterprise, traditional storage system vendors, increased 16.5% to $38.0 billion in 2022 - indicating a shift of storage spend towards on-premises DCs for 2022.

Enterprise vendor external storage results, by company

- The group of ODMs working directly with cloud infrastructure buyers to provide white box storage shipped the most storage in 2022, accounting for 40.5% of market revenue.

- Dell EMC was the largest single vendor in the storage market with 19.4% of total revenue share during the past year, marking signs of growth recovery in 2022.

- Huawei took the third vendor revenue spot, after shipments surged up in the last two quarters of 2022, as Chinese markets opened after the end of the zero-COVID policy. NetApp maintained the fourth spot for the year, even in the face of a very weak fourth quarter.

- The darling of the year was Lenovo, which is finally seeing some great storage growth with a 138% YoY revenue increase for 2022. In 4Q22, Lenovo registered a three-fold jump in YoY revenue. Lenovo appears to have created an increasingly successful joint venture with NetApp after struggling for years to find an optimal storage strategy. Another driver for Lenovo’s success was its partnership with cloud service providers, as it shipped JBOF storage to hyperscaler cloud SPs as a part of its “ODM plus” strategy.

Source: Omdia © 2023 Omdia

Amidst cloud inventory burn down and despite economic headwinds, enterprise expected to continue buying storage

Looking forward, 2023 is certainly shaping up to be a challenging year. Macroeconomic headwinds are exacerbated by an overstock in storage devices and underutilized cloud storage capacity. Large cloud service providers have experienced an increase in free capacity from customer repatriating. Taking all this into account, Omdia expects below average 10% YoY total DC storage growth with much of it coming towards the last half of 2023.

Notably, we have not seen drastic cuts to on-premises DC budgets, which indicates the enterprise market segment (traditional) is in better shape than the cloud SP segment. We believe that the modern digital enterprise sees storage and data management as strategic to its future, and not an area to play around with when looking for savings.

Additional highlights from the Omdia DC Storage report include:

- Omdia expects the external DC storage market to expand from $56.7 billion in 2021 to $106 billion in 2026, a 5-yr CAGR of 13.3% (includes arrays and server expansion).

- All-flash array category rose 19% in 2022, which includes the categories of SAS / SATA and NVMe, SSD populated storage.

- White-box vendors were still no. 1 in revenue market share in 4Q22 at 36%, which trended down from 40% share in 4Q21, as quarterly cloud storage growth slowed.

- Storage revenue into the Asia and Oceanic region grew 9.8% YoY in 4Q22, as storage shipments picked up for the quarter, especially in China.

About the Omdia DC Storage Tracker and Intelligence Service

The Cloud and Data Center practice anchors Omdia’s Data Center (DC) services. Our DC Storage Intelligence Service supplies clients with two quarterly DC storage trackers - traditional and software-defined - going back to 2018. Analysts for the storage service have deep technology expertise, which is used to provide topical research, opinions, and forecasts throughout the year to a client portal for viewing and download. When possible, the data for this report is obtained directly from the storage vendors, and alternately from public sources, conference presentations, and analyst briefings.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions