Fine pixel pitch LEDs continuing to expand in virtual production

Virtual production is one of the leading areas of interest for LED video displays currently, as the shift to utilize this technology accelerated during the COVID-era, especially with streaming companies such as Netflix and Amazon growing their use of LED video displays in virtual production facilities.

More recently, growth in virtual production extends beyond film and more interest stems from the education sector as well, especially for higher education and universities. LED video walls for instruction in virtual production are used by faculty or students working in film or TV production, performing arts, or technical arts. ROE Visual currently dominates this market with majority share among virtual production and XR stages, although other brands are also beginning to penetrate this market, including Leyard, Samsung, and Sony within the past year.

The rise of VR and XR stages used for virtual production within the education, advertising, or the corporate sector, are anticipated to be an area of opportunity and growth in 2023. While these virtual production studios are not on the same scale as their film counterparts, they are often smaller in size, but the quantity of these second ‘tier’ virtual production studios are increasing in the market.

Based on Omdia’s latest LED Video Displays Market Tracker, corporate signage includes LED video displays used not only for virtual production, but also includes displays placed over the entrance of corporate buildings, office lobbies, board rooms, show rooms, conference rooms, training centers, and broadcast studios. Revenue for indoor fine pixel pitch (FPP) LED video products within the corporate sector is forecasted to increase nearly 20% year-on-year for 2023.

Experiential LEDs drives retail and public space installations

The return to in-person activities prompts investment and upgrades within the retail and public space sectors for both indoor and outdoor signage. Companies recognize the importance of creating an immersive and memorable experience within these sectors. In particular, demand for LED video displays in these markets is rising to refresh storefronts, shopping malls, building facades, and entertainment venues, among other applications.

Innovative use cases are on the rise, for example, at CES 2023 earlier this month, a Shenzhen company called Muxwave is a “holographic” LED screen solution provider that offers a unique twist on transparent LED displays. Muxwave’s approach to transparent LED displays differs from other transparent mesh LED products since it does not contain any structural skeleton, making it lightweight, thin, and flexible for both flat and curved installations. Muxwave has two product lines: the M3 and M6, available in 3.91mm or 6.25mm pixel pitches, respectively. Additionally, these transparent LED screens can achieve up to 80% transparency with 4,000 nits brightness that are able to be mounted or glued to glass surfaces, hanging or free-standing, as well as floor standing.

Target markets for these types of transparent LED displays include both indoor and outdoor locations, ranging from consumer electronics applications to commercial spaces in luxury stores, shopping malls, specialty venues, automotive showrooms, exhibition centers, and other window-facing scenarios.

21:9 aspect ratio encourages LED video adoption in corporate sector

Last year, Microsoft introduced their new Front Row experience intended for the corporate sector’s hybrid work setting, creating a more seamless meeting space for in-room and remote colleagues. These new Microsoft Teams Rooms work best with the recommended 21:9 aspect ratio, with LCDs offering a limited number of options for these ultra-wide large format displays, mostly available in 81- or 105-inch sizes and 5K resolution.

However, with the shift to LED video displays in corporate and conference room applications, Omdia expects an increased presence of fine pixel pitch (FPP) LED video walls as many companies are still upgrading their mid- to larger meeting rooms and boardrooms. These technology upgrades are intended to generate more interest to enrich the employee experience while adapting to a hybrid work schedules. Since LED video displays offer greater number of options for larger display sizes above 100-inches, momentum for LED video walls within corporate and conference rooms utilizing the ultra-wide aspect ratio is anticipated to drive a lift in FPP LED video displays for 2023, namely in 1.2mm and 1.5mm pixel pitches.

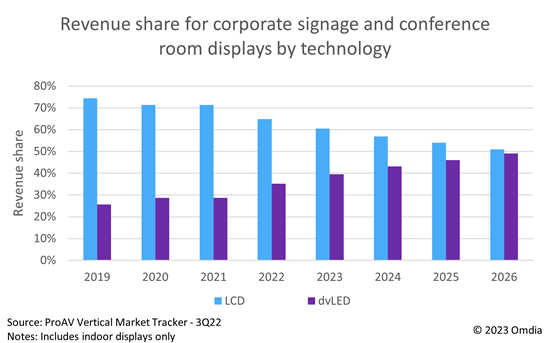

According to Omdia’s latest ProAV Vertical Market Tracker, total overall revenue for indoor corporate signage and conference room displays for LCD and LED video displays reached over $4.4bn in 2022. For 2023, Omdia expects nearly 40% of revenue from corporate signage and conference rooms for indoor displays to come from dvLED. Revenue from both technologies is forecasted to be nearly on par by 2026, with average growth of 19% anticipated each year from 2023 through 2026.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions