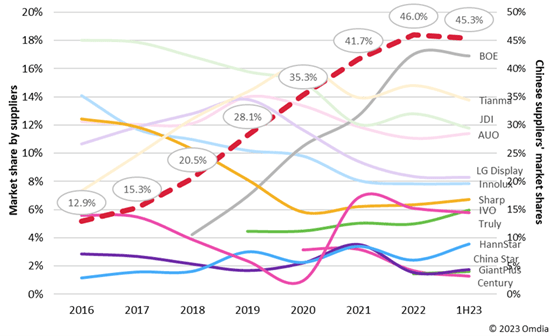

Chinese companies have emerged as top suppliers in the automotive display market in 1H23, extending their lead in the display industry after dominating the TV and smartphone display markets. According to Omdia’s Automotive Display Intelligence Service, Chinese companies hold 45.3% of the market, a significant increase from their 12.9% share in 2016.

BOE and Tianma are the two major contributors to this growth, with their combined share reaching 30.7%. In 1H23, BOE stands out as the only panel supplier with a market share of over 15%. Tianma follows with a 13.8% share. IVO, which acquired a 6% share, successfully replaced Truly and became the third-largest Chinese supplier. China Star is expected to quickly become the new rising star, rapidly expanding its share.

Figure 1: Automobile monitor display unit shipment share by suppliers and Chinese players’ shares

Source: Omdia

Chinese suppliers currently dominate the a-Si LCD market with a majority share of 55.5% but have a relatively smaller share in the LTPS LCD market. BOE is the only Chinese supplier capable of mass-producing OLED automotive displays and has acquired a 17.8% share. The company has ample capacity to meet the demands of the automotive display market, with two Gen 8.6 TFT LCD fabs (one a-Si, the other oxide) and two Gen 6 OLED fabs that offer affordable platform models.

Figure 2: Automobile monitor unit shipment share by region, 1H23

Source: Omdia

In addition to BOE, HKC, Tianma, and China Star have also planned to allocate a certain amount of Gen 8.x a-Si/Oxide LCDs for automotive use. BOE and Tianma are set to shift more LTPS LCD capacity from smartphone display to automotive after China Star. On top of BOE and EDO, Tianma, China Star, and Visionox also plan to manufacture OLED automotive displays. The Chinese players’ strength in cost and capacity will continue to give them an advantage in dominating the automotive display market.

Figure 3: Chinese suppliers’ automotive production lines overview, 1H23

Notes: *= under planning and not yet mass production; # = may not build.

Source: Omdia

To read more insights and analysis covering market trends and industry forecasts prepared by Omdia’s Display practice, click here.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions