The transition from traditional audiovisual (AV) infrastructure to Internet Protocol (IP) based solutions is nothing new. IP networks offer multiple benefits including scalability, quicker response to needs, and the capability to support any video and audio format over a local area network (LAN), wide area network (WAN) or cloud network. The declining cost of hardware is fueling adoption, encouraging Pro AV installations to migrate to IP. Some estimates suggest a 10% to 15% migration rate across all Pro AV networks.

However, many of the solutions used to replace traditional AV infrastructure with IP have been mostly proprietary, vendor-closed, and running on 1G networks. In recent years, product interoperability, based on licensed protocols and open standards, has been gaining momentum.

The year 2022 welcomed two promising AV over IP initiatives, AIMS’ IPMX and Audinate’s Dante AV, joining the ranks of SDVoE, NDI and other proprietary solutions. However, the lack of standards alignment, perceived vendor lock-ins, uncertainty regarding the network capacity requirements for specific use cases, and product interoperability, are some of the bumps along the road for widespread AV over IP adoption.

Nevertheless, the market is at the beginning of this transition, with each one of these new solutions having its unique place. The advantages and benefits they offer across a range of applications and use cases position them for coexistence and adoption in the coming years.

AV switching equipment on a steady path to becoming IP-enabled

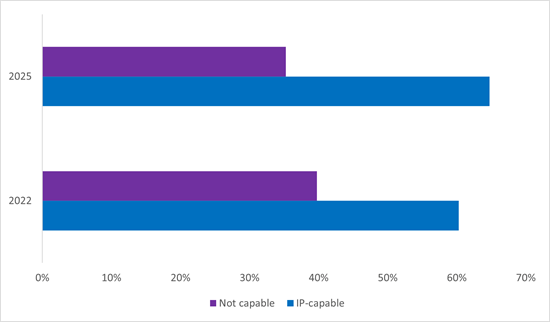

At the core of an AV network is the AV switcher. Traditionally video switches have been hardwired, circuit-based switching technology, where the transport of signals is point-to-point and limited to the input/output capability of the switch. IP switches in Pro AV lift this limitation, in terms of total signal inputs and outputs, and remove the need to be symmetrical. Furthermore, they can be connected to expand and scale up or down the network. A recent custom report by Omdia estimates that 60% of all routing and switching equipment shipped in 2022 was IP-capable. As migration to pro AV over IP increases, 65% of all routing and switching solutions shipments for the Pro AV market will be IP by the end of 2025.

Figure 1: Pro AV signal routing and switching equipment, IP-capable and non-capable

Note: IP-capable refers to devices fitted with an RJ45 and IP-able. Not capable refers to point-to-point devices.

Source: Omdia

Capture equipment: IP-enabled cameras are on the rise

Networking capability is well-penetrated in Pro AV cameras. Overall, about 48% of all cameras shipped were networkable and fitted with an RJ45 connector in 2022. The penetration is expected to increase to 55% by 2025. However, penetration varies by sub-category. In 2022, high-end production cameras were 100% IP capable, while 86% of all video conferencing cameras were IP capable. Omdia estimates that about 30% of USB cameras have ethernet connectivity, with this penetration remaining constant over time, as only very high-end units boast ethernet capability.

Figure 2: Pro AV camera shipments, IP-capable and non-capable

Note: IP-capable refers to devices fitted with an RJ45 and IP-able. Video surveillance cameras are not included.

Source: Omdia

AV over IP initiatives for high-performance signals

The AV over IP solutions that have emerged in the last few years do not necessarily compete for the same space, although they seem to do so at first glance. Some of them are proprietary, closed system implementations with technologies from vendors such as Crestron, Just Add Up, and Extron. Solutions aiming at openness and interoperability and based on protocols and standards include, but are not limited to, the already mentioned SDVoE, IPMX, Dante AV and NDI.

SDVoE: The not-for-profit Software Defined Video over Ethernet (SDVoE) Alliance released SDVoE technology to standardize the adoption of AV over IP and foster product interoperability and collaboration as an alternative to HDBaseT. Based on a Semtech ASIC device, it is license-based and runs on a 10G network, extendable to 40G. SDVoE has the longest presence in the market, with a strong list of partners and products supporting the protocol. Very strong when it comes to latency, it depends on a single processor provider.

IPMX: IP for Media Experience (IPMX) is a set of protocols based on standards used in the broadcast industry. IPMX was released by the not-for-profit Alliance of IP Media Solutions (AIMS). IPMX is 80% SMPTE standards and 20% open specifications to add features for the Pro AV industry, although some codec license fees may apply. It supports a range of network capacities from 1G to over 25G, with very low latency and high-quality image transmission. It currently supports uncompressed media, but support for H.264/H.265 codecs is on the roadmap. IPMX requires vendor investment for adopting and implementing the standards into products, which might be seen as a barrier.

NDI: Developed by Newtek, Network Device Interface (NDI) was initially intended for video signaling transport into their TriCaster solution. NDI has developed its own ecosystem and offers a free Software Development Kit (SDK) for implementation and compliance, ensuring interoperability. A licensed SDK, NDI Advance, was later introduced to provide vendor support and certification. It supports H.264/H.265 for high compression and Ecotec Speed HW, a proprietary low-compression codec. With gaining popularity within the IT community, NDI is expanding to multiple verticals. Its low cost to entry and single control plane offering have made the protocol strong in the production and PZT cameras market. Not suitable for very-low latency implementations, it is usually deployed in dedicated networks.

Dante AV: Developed by Audinate, it is the latest to enter the market, with three versions targeting different use cases and applications depending on the latency required. Dante AV Ultra, an FPGA-based solution, aims at the high-end market with ultra-low latency supporting JPEG200. Dante AV A, a partnership with SoC platform provider Aspeed, is optimized for the installed commercial video distribution market, such as videowalls. Dante AV H is a low-bandwidth software solution supporting H.264, allowing for discoverability, routing, and management through a Dante network. Dante benefits from the high penetration of its audio networking solution and range of offerings. Its ultra-low latency solutions are hardware-based and can be perceived as a barrier.

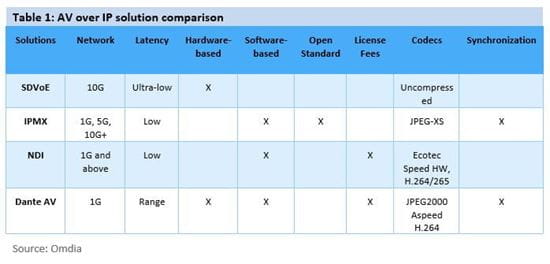

A snapshot comparison

Comparing the characteristics and features of the competitive protocol may not provide a fair assessment, given each is better suited for specific use cases or applications. A frequently discussed comparison among these protocols is the network size required. Typically, 1G networks are the common set-up for AV networks. Moving to larger networks seems inevitable as video and data demand escalates. Table 1 shows a comparison snapshot of some characteristics of the AV over IP solutions.

AVoIP vendor and product adoption

NDI and SDVoE have the longest presence in the market, resulting in having the widest adoption among vendors. The free SDK offered by NDI has garnered the support of around 160 vendors, although the number of certified vendors is much smaller, as the licensed SDK allowing for NDI certification was introduced recently. Many of these vendors specialize in camera hardware. Meanwhile, the SDVoE Alliance has almost 60 members and over 200 products in the market.

At InfoComm 2023, over 20 vendors were demonstrating IPMX products. Underpinning IPMX is the AIMS consortium with 67 members. Dante AV, albeit a late entrant, has already secured the support of at least 32 licensee vendors across its three marketed products. The latest Dante AV solution announced at InfoComm 2023, AV-A, will start shipping in the last quarter of 2023.

Network capacity migration

The declining price of ports and equipment is paving the way to speed up the transition from 1G to 10G networks. In the last year, some Pro AV distributors have reported price reductions of 18% for 10G hardware.

However, one main barrier to this transition is the existing cabling infrastructure. While most current AV networks operate on CAT5 and CAT6 cabling standards for 1G networks, 10G networks require an upgrade to CAT7 cabling. Hence, migrating an existing network to 10G does not entail just an investment in hardware but also the additional cost of replacing the existing cable running through the walls of a building with CAT7 cabling.

Consequently, the shift to 10G has been relatively slow and predominantly in new builds, where AV networks are built on 10G, or the infrastructure is laid out with foresight for future migration. However, some distributors have seen a two-fold increase in demand for 10G solutions in the past 10 months, mostly going into science facilities in higher education, new corporate buildings, especially for information signage applications, and stadium networks.

Hardware-based vs. software-based technologies

Hardware-centric technologies, such as SDVoE or Dante AV Ultra, that operate on dedicated chipsets or modules, benefit from very low latency and superior image resolution. These attributes significantly enhance the synchronization and quality of images, making them particularly useful for image magnification implementations in live event settings, among others. However, solutions based on chips can only offer a single technology. Implementing multiple AV over IP technologies in a single product, when one of them is chip-based, becomes too costly, as additional chips would be required in the AV device.

On the other hand, software-based solutions can theoretically coexist on the same device, through the download of the relevant licensed codes. From the perspective of the end-user, having a product capable of supporting NDI and Dante AV H or SDVoE technology might be irrelevant to their specific requirements. However, for vendors, an SKU that supports multiple solutions can be positioned for different use cases or verticals. For example, Dante AV H in theory could coexist with SDVoE products (an agreement exists between the software vendor and the SDVoE Alliance) or with NDI. Despite this potential, the market has yet to witness the introduction of such a product. However, multiple licensing fees would be required for the same device. One solution to this would be making the license fee payable when the solution is activated by the end user.

Will all AV networks run on IP?

Omdia’s view is that traditional AV infrastructure will continue to hold a significant place in the market. Scenarios requiring negligent latency, such as casinos, will remain on traditional AV infrastructures. Networks where the number of inputs and outputs does not surpass 10 are unlikely to grow, while those characterized by shorter distances, mission-critical AV operations, and a high emphasis on cybersecurity, are likely to retain their traditional AV frameworks for the forthcoming 5 years at least.

Conversely, AV networks exceeding 10 inputs/outputs are on a clear trajectory towards adopting IP. The choice among the different AV over IP solutions depends on manyfactors, including the specific use cases, applications, and unique needs of the end-user. Priorities may vary from seeking a high-quality image at the lowest possible compression, low latency, and efficient bandwidth utilization to cost-effectiveness. Regardless of needs and choices, the near future is promising for solutions providers in the AV over IP solutions domain, fostering a competitive and even collaborative space catering to the diverse requisites of the industry over the next five years.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions