Kimi Lin, Omdia Senior Research Analyst, Touch, Cover Lens & Fingerprint explores the rapidly evolving OLEDoS display market, where prices are plummeting due to increased competition and advancements in manufacturing in his latest analyst commentary.

Wafer foundries strongly influence OLEDoS prices

The structure of an OLEDoS (Organic Light-Emitting Diode on Silicon) displays is similar to AMOLED displays but with one key difference: OLEDoS utilizes silicon circuitry as a backplane instead of TFT circuitry. This shift allows for a more mature full-color technology, with a common solution being the use of a white light and color filter. However, this method results in higher light loss. Brightness can be enhanced by enhancing OLEDoS materials, tandem stacks, or direct fine vaporization.

OLEDoS are particularly suited for closed device designs, such as virtual reality (VR) and mixed reality (MR) (video see-through) applications, due to their perfect contrast. However, their luminance levels may be too low for augmented reality (AR) devices (open designs) that use passthrough waveguide optics. Despite Apple’s Vision Pro sales falling short of sales expectations, it has still contributed to the growth of OLEDoS shipments and market share.

Given that OLEDoS relies on silicon circuitry, wafer foundries play an important role in determining the price of these displays. For instance, the 1.03-inch OLEDoS display can yield 120 units on a 12-inch wafer but only 48 units on an 8-inch wafer. Higher efficiency translates to reduced costs and lower selling prices. As a result, many Chinese companies have invested in 12-inch OLEDoS production lines in recent years.

Prices of OLEDoS displays are rapidly decreasing owing to fierce competition and to boost sales

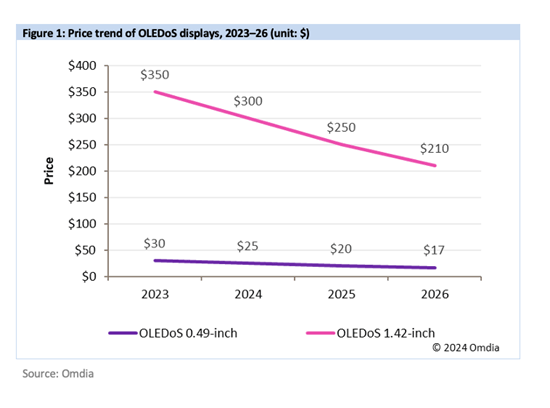

A notable example is the 1.42-inch OLEDoS display supplied by Sony for Apple’s Vision Pro. Initially priced at $350 per piece, negotiations have brought the cost down to $300 per piece. Despite this reduction, the OLEDoS display remains the largest cost component of Apple’s Vision Pro, accounting for 33.4% of the total component cost.

As manufacturers such as SeeYA and SDC actively seeking to join Apple’s Vision Pro supply chain, Omdia predicts the OLEDoS display will be the primary target for cost reductions in future iterations of the Vision Pro. There is still significant potential for further price decreases.

Currently, the main supplier of the 0.49-inch OLEDoS display is Chinese maker SeeYA. As BOE increases shipments and SIDTEK begins mass production, competition is expected to intensify, and Omdia expects prices to continue dropping, falling to $17 per piece or even lower by 2026.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions