As consumer preferences evolve alongside rapid advancements in vehicle technology, the demand for intelligent vehicles continues to surge. From seamless connectivity to enhanced safety features, today's car buyers are seeking more than just a mode of transportation—they're looking for a personalized, integrated experience. Are automakers ready to meet these expectations? In this exclusive blog, Canalys analyst, Jason Low explores how the shift toward smarter, more connected vehicles is reshaping the industry and what it means for the future of automotive innovation.

According to Canalys forecasts, over 40% of passenger vehicles sold in China during 2024 will be EVs, solidifying the country's leadership in electrification and technological integration. In today’s rapidly evolving automotive market, Chinese consumer expectations have transformed at an extraordinary pace alongside technological advancement. They are no longer focused solely on price but are increasingly willing to spend across pricing tiers when a product offers genuine value, advanced features, and a seamless, connected experience.

Baseline-connected features are no longer sufficient

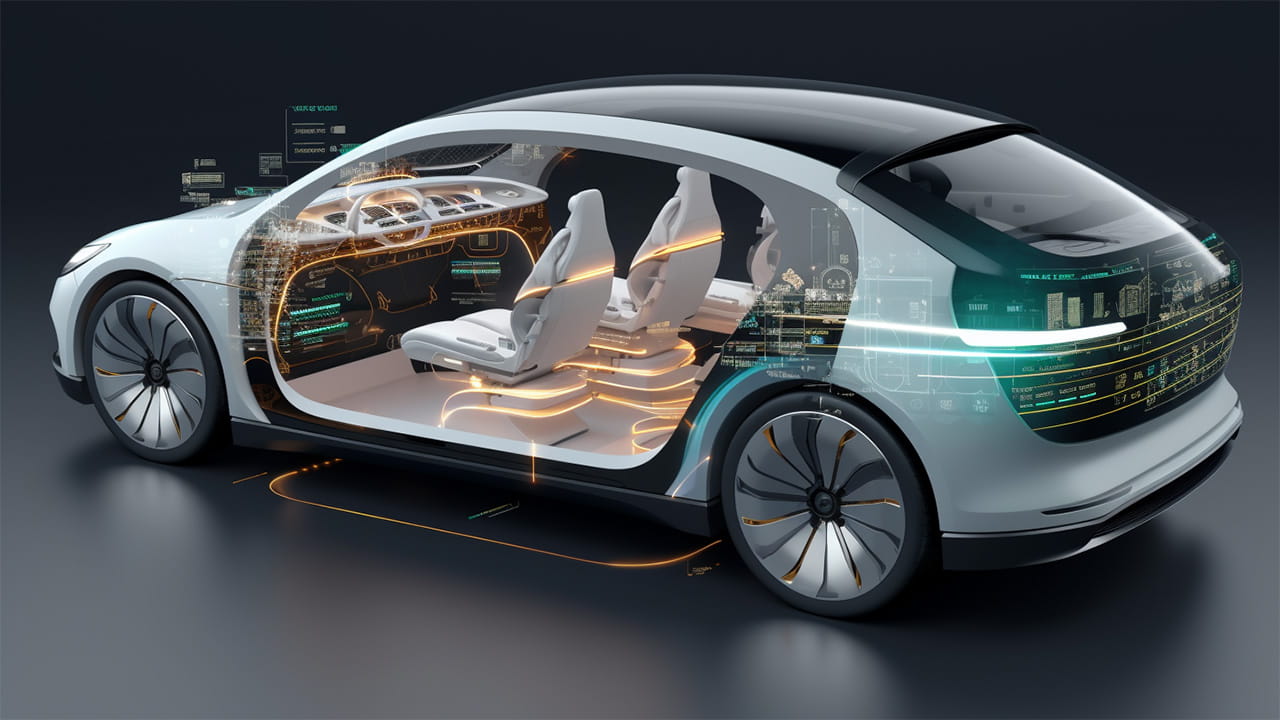

It is no exaggeration to say that most car buyers, particularly younger generations, now expect vehicles to feature a high level of digital cockpit and connectivity capabilities, regardless of whether the model is a standard compact car or a high-end SUV. Connected vehicle technology has transitioned from being a premium feature to a universal selling point across all vehicle categories.

Whether through advanced display options, intuitive controls, or customizable lighting, in-cabin technology is becoming more sophisticated and accessible—even in traditional internal combustion engine (ICE) vehicles. Leading brands like Volkswagen have integrated these tech features across their ICE models, demonstrating the universal appeal of digital cockpits. This trend is especially pronounced in the SUV/crossover market, particularly in higher-priced BEV and PHEV segments. Chinese brands are driving this shift by integrating superior technologies and offering better value for money to compete with established incumbents. With growing demand for connected features and lower integration costs, digital cockpit penetration rates in China are expected to rise rapidly.

Modern consumers enjoy a wide variety of choices and have become increasingly selective, placing a premium on unique offerings across different vehicle categories. This trend is prompting automakers to introduce advanced features that enhance in-cabin comfort and environmental controls, often leveraging AI and mobile devices to deliver tailored functionalities for specific user scenarios. Custom user experiences—such as modes dedicated to children, passenger entertainment, or rest/charging—are emerging as highly desirable differentiators. These features help brands distinguish themselves by enhancing how passengers interact with and personalize their vehicles. Xiaomi, for instance, has been praised for seamlessly integrating its devices and software to create an ecosystem of accessories, delivering a user experience that is difficult to replicate.

Smartphone integration is still a key factor of influence

Despite the rise of digital cockpits, some drivers still prioritize fundamental features like music, navigation, and basic information. Smartphone mirroring remains a key consideration for buyers, especially in China, where demand for smartphone integration with digital cockpits is high. Huawei has emerged as a prominent player in this space, gaining traction with its HiCar and HarmonyOS platforms. HiCar adoption has surged as Huawei’s branding and technology ecosystem attract partnerships with major car manufacturers. In vehicles supported by the Harmony Intelligent Mobility Alliance (HIMA) or HarmonyOS, consumers experience the same level of personalization and app continuity as on their Huawei smartphones, further blurring the lines between mobile and automotive ecosystems. While not all mobile apps are necessary in vehicles, the ability to access them remains an attractive value proposition.

Priority shifting to safety and driving dynamics

Chinese consumers are increasingly prioritizing safety and driving quality, and automakers are responding with innovations to meet these expectations. Chinese brands are leveraging advanced technologies to gain a competitive edge, from enhancing ADAS capabilities with high-performance SoCs running AI-enhanced models to offering intelligent chassis with customizable damping control and adaptive suspension. These advancements not only improve safety but also allow vehicles to offer customizable driving characteristics, enhancing enjoyment and catering to diverse consumer preferences. Conservative buyers in the premium segment are now more likely to compare domestic options against established global brands, with safety and ride quality emerging as deciding factors for many.

Continuous improvement will keep users happy

Consumers value brands that provide regular updates to enhance existing features and introduce new ones. The intelligent vehicle market is highly dynamic, and continuous improvement is essential for maintaining customer satisfaction. While many advanced driving and parking features, particularly high-level ADAS, are available today, they often require multiple updates to achieve full maturity. Brands that commit to long-term software support are gaining loyalty, as consumers view this commitment as a clear indicator of innovation and reliability.

Companies that prioritize software updates, offer unique in-car experiences, and establish strategic technology partnerships are positioned to stand out in this competitive market. Connected vehicles are no longer just about getting from point A to point B; they are increasingly becoming an extension of the consumer's digital life.

Canalys, part of Informa TechTarget, is a leading global technology market analyst firm with a distinct channel focus. To learn more visit the Canalys website.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions