Gen 10.5 TFT lines began mass production in 2018. Currently Gen 10.5 is the largest TFT generation line, specifically designed to produce eight 65-inch panels or six 75-inch panels from a single sheet. BOE initiated mass production with its first Gen 10.5 B9 line in 1Q18. Most Chinese panel makers have a seven-year depreciation timeline, while building depreciation typically spans 20 years. Following BOE’s lead, China Star and Sharp also successfully invested in Gen 10.5 TFT lines.

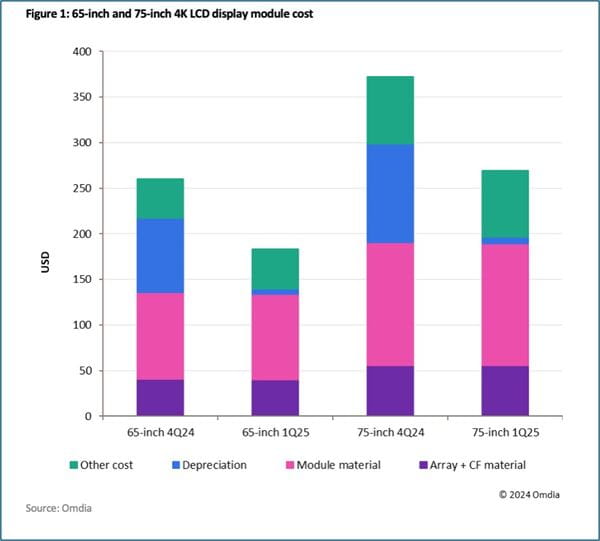

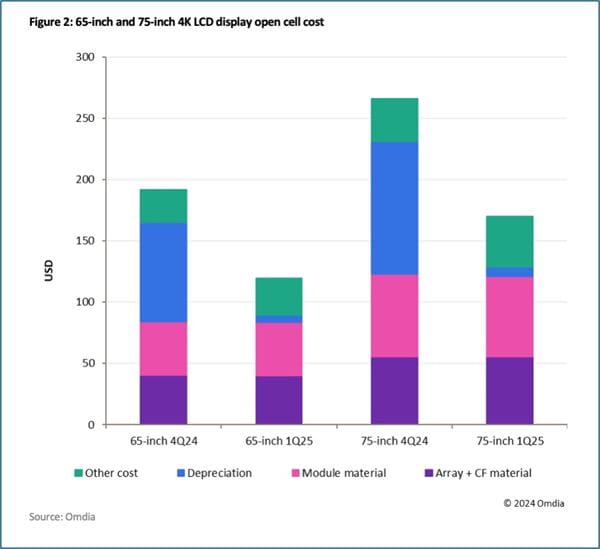

From 1Q25 onward these Gen 10.5 lines will begin completing their equipment depreciation, leading to significant cost reductions for 65-inch and 75-inch 4K LCD panels. Omdia has simulated the cost changes for these modules and open cells before and after deprecation as shown in Figure 1 and Figure 2. While the building will continue to depreciate, full equipment depreciation in 1Q25 will allow panel makers to reduce total module and open cell costs. This shift will enable panel makers to boost demand without sacrificing profit margins and to increase utilization rates at their Gen 10.5 facilities.

To read more insights and analysis covering market trends and industry forecasts prepared by Omdia’s Display practice, click here.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions