The impact of Hisense’s first RGB Mini-LED backlight LCD TV on the market

Hisense has opened pre-orders for its 116-inch RGB Mini-LED TV at ¥99,999, undercutting rivals and reshaping expectations in the ultra-large premium TV market. A new blog from the Omdia team breaks down what this means for the industry.

Hisense is now accepting pre-orders for its 116-inch RGB Mini-LED TV on JD.com for ¥99,999. The display was first showcased at CES 2025 in January and attracted attention at China’s AWE home appliance event last month.

Hisense's launch price challenges industry pricing norms

- Without delving into the technical differences between RGB Mini-LED and conventional Mini-LED backlight technology, the sheer scale of Hisense’s 116-inch LCD TV makes stands out. It slightly surpasses the current largest mass-produced LCD TV—115-inches—offering a clear marketing advantage based on size alone.

- Typically, new display technologies debut at premium prices that place them well beyond the reach of most consumers. Samsung’s first Micro-LED TV launched at a higher price point, while LG Electronics introduced its rollable OLED TV at approximately $100,000. Similarly, LG’s 77-inch transparent OLED TV (OLED-T 77), released in North America in December 2024, debuted at $59,999.

- In contrast , Hisense has priced its 116-inch RGB Mini-LED backlight LCD TV at ¥99,999 in China - $13,779. After deducting the 13% VAT, the adjusted price is closer to $11,987 when using US pricing standards. While this model is currently exclusive to the Chinese market, there is no confirmation it will launch with identical specifications or pricing in the US. However, it still compares favorably to TCL’s 115-inch TV, which is listed at Best Buy for $19,999.99. TCL’s 2025 model features Google TV with QD Mini-LED technology, while LG Electronics’ largest OLED offering for 2025, the 97-inch OLED TV, carries a price tag of $24,999.

- Hisense’s pricing strategy isn’t new. When TCL disrupted the US market by launching an ultra-large 98-inch TV at $1,999, Hisense responded by releasing a 100-inch Mini LED TV at a similar price point. Rather than attaching a premium to larger sizes or advanced specs, Hisense has focused on competitive, consumer-accessible pricing in the XXL TV segment. By eliminating the usual price premium Hisense has positioned itself to gain market traction and compete directly with more established brands such as TCL in the ultra-large screen segment.

Latecomers must balance picture quality and cost

- Several TV brands – including Samsung, Sony, LG Electronics, and TCL – are currently developing RGB Mini-LED TVs, , but they now face competition from Hisense, which has moved early to establish a presence in the market.

- While many of these brands are targeting mass production by 2026, Samsung reportedly preparing to launch its first RGB Minu-LED TV this year.

- Had Samsung or Sony introduced the first RGB Mini-LED TV, it likely would have debuted at a premium price point to secure technological leadership, justify development investments, and create a strong marketing impact.

- In such a scenario, late entrants would have had an opportunity to compete through more aggressive pricing to maintain market balance. However, Hisense has reversed this dynamic by launching early with a lower price point than existing alternatives, complicating pricing strategies for later competitors.

- RGB Mini-LEDs require an additional two chips beyond the blue or the white chips that are conventionally used, and individual drivers for each adding to production complexity and cost.

- Hisense’s pricing has now set a benchmark, creating a challenge for other brands. If their products are priced significantly higher without a noticeable improvement in picture quality, they face market resistance.

- Hisense appears to be relying on development efficiency and cost control, to maintain competitive pricing and apply pressure on rivals aiming to establish an early market share.

Increasing competition with OLED TV

If RGB Mini-LED TVs become widely adopted by 2026, the premium LCD segment may become robust, creating a clearer long-term path for high-end LCD development.

In this scenario, higher pricing for advanced LCD TVs could help strengthen the overall premium category - benefiting OLED TVs by reinforcing their position as a luxury option.

However, if the new models, such as Hisense’s 116-inch TV are priced similarly to existing LCD products, the picture quality will improve, but the price gap between LCD and OLED TVs will remain substantial. This could increase the appeal of premium LCDs and potentially put pressure on the OLED segment, negatively impact the OLED TV market.

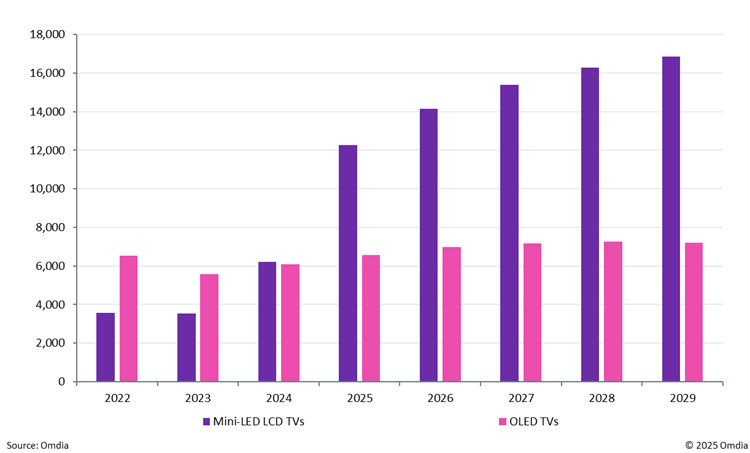

Mini-LED TV market poised for further growth

The Mini-LED TV market has the potential to strengthen further with the introduction of new RGB models. While Hisense’s 116-inch TV alone may not shift the market in terms of overall sales volume, it marks a key moment in the evolution of high-end LCD technology. Anticipated products launches from Hisense and possibly Samsung later this year, followed by Sony, LG Electronics, and TCL in 2026, are expected to help establish RGB Mini-LED technology as a viable premium display option.

This momentum could also drive growth in the broader Mini-LED segment by expanding both the upper high-end and more accessible price tiers. As a result, the technology may gain greater visibility and appeal across a wider range of consumers. Ultimately, the most critical factor will be how consumers respond to the first wave of RGB Mini-LED TVs hitting the market in 2025, which will play a major role in shaping the future direction of this segment.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions