Since the second Trump administration took office earlier this year, tariffs and trade tensions have been among the key defining and controversial topics. Some of the most impacted countries are key manufacturing hubs for consumer electronic products, including smartphones, to the U.S. Even though smartphones largely have been exempted for now, the significant uncertainty has made the largest smartphone vendors apply tactical measures.

In this climate, “supply chain resilience” is a key term, referring to a company’s ability to adapt and recover from unexpected disruptions. Supply chain resilience optimizes for predictability and low risk. It does not optimize for lower costs or short-term gain, but rather to reduce the likelihood of cost or supply shocks. It does not come without risk, though, as it, for example, can lead to a costly surplus of inventory that may be difficult to sell to end-buyers. However, it is a calculated risk, much like how companies use financial derivatives to hedge against currency or commodity volatility. For the largest vendors, predictability outweighs short-term cost optimization.

In the first half of 2025, the largest vendors in the U.S. smartphone market have leveraged their diversification strength—such as an assembly hub in several countries—to move tactically as they navigate potential disruption. Three core tactics have been at the forefront of the largest smartphone vendor’s mitigation tactics.

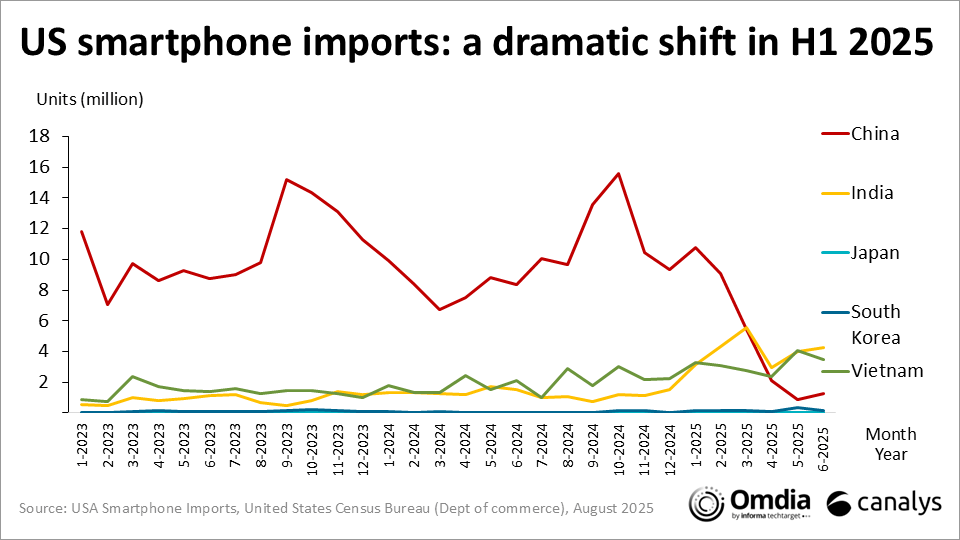

Frontloading inventory before the tariffs come into force

Apple and Samsung, which together make up over 80% of smartphone shipments in the U.S. market, have used inventory frontloading as a key tactic. Due to their dominant roles in the market, their frontloading has a major impact on shipment dynamics. However, Apple and Samsung utilized different timelines when scaling up their inventory, partly due to varying urgency based on their production areas, skewing their short-term quarterly shares.

Apple frontloaded a substantial proportion of iPhones into the U.S. toward the end of Q1 2025. Consequently, Apple’s shipments grew by a massive 26% year on year in Q1, which resulted in Apple reaching its highest market share for a first quarter, with 61%. However, in Q2, Apple adjusted its inventory levels somewhat downward, resulting in a corrective 10% year-on-year shipment decline. For the two quarters combined, Apple’s shipments grew 9% year on year and it held 55% market share.

In contrast to Apple, Samsung first started to frontload devices in Q2 2025. In Q1, Samsung’s shipments grew by a marginal 2%, which reflected a positive reception to the Galaxy S25 series. In Q2, Samsung’s shipments grew by 38%, mainly related to inventory frontloading. For the two quarters combined, Samsung’s shipments grew 17% to 27% of market share. However, Samsung will likely undergo a similar adjustment correction to Apple in Q3, meaning that a longer time horizon will still be needed to assess the sales-through performance of the two brands.

While the timing of their frontloading differed, the underlying principle was the same—to create a buffer against future price shocks and supply interruptions. Interestingly, this frontloading provides a window into which models vendors are most confident can deliver a strong sales-out performance with consumers and businesses.

In Apple’s case, it has led to consistent growth across its portfolio, including the iPhone 16 Pro and Pro Max. Apple’s high shipments of the iPhone 16 Pro models are a clear signal that Apple believes it will continue to deliver consistent demand for these devices, in line with the growing interest these models have received in recent years.

In Samsung’s case, the entry-level Galaxy A16 5G and A15 5G, alongside the Galaxy S25, S25 Ultra, and S25 Plus, stood out as the company’s top-selling models. Shipments of more niche models—such as the slim Galaxy S25 Edge and its foldables—remained relatively low.

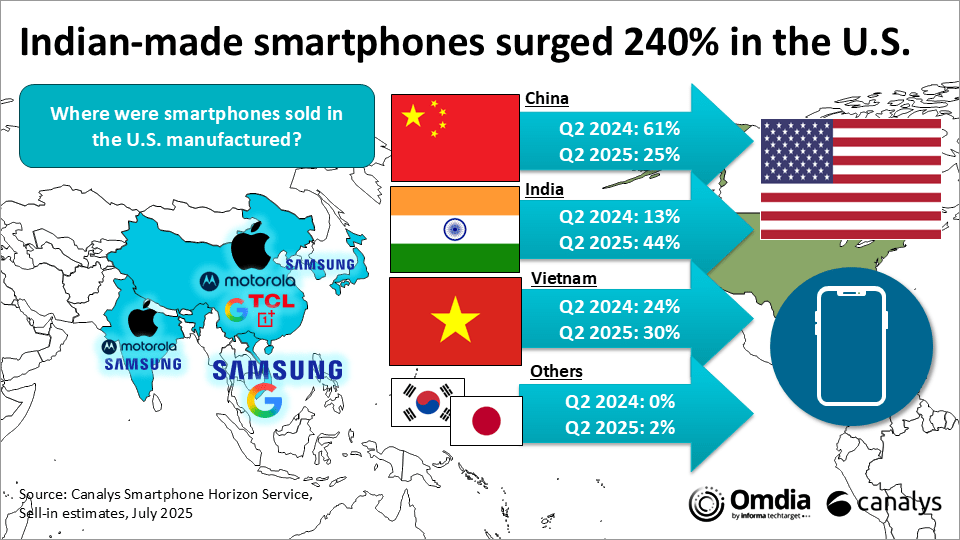

Supply chain reorientation: the India pivot

In Q2 2024, 61% of smartphones imported into the U.S. were from China, 13% from India and 24% from Vietnam. However, in Q2 2025, this had dramatically changed. India became the largest manufacturer of smartphones shipped into the U.S., with 44% of all units, with Vietnam reaching 30% (partly inflated by Samsung’s frontloading in Q2) and 25% from China.

Vendors’ ability to shift their U.S. supply routes around so quickly resulted from a gradual supply chain diversification strategy that started in 2020 to avoid overdependence upon China, often referred to as “China+N strategies”. While PC vendors have focused on Vietnam, Thailand and Mexico, India has emerged as the additional assembly hub for many smartphone vendors.

For Apple and Motorola, India is the major growth target up to 2030. Building export capacity has been effective alongside scaling the local supply capacity needed to be price-competitive in India. India is still mainly an assembly hub, which should be considered a first key step for other components of the smartphone supply chain to relocate to the country in the coming years.

Apple was the major accelerator in India in H1 2025. Interestingly, Apple has built up its iPhone export capacity over the last years, supplying many regions worldwide. However, almost all of India’s iPhone export capacity was allocated to the U.S. in H1. In Q2 2025, over 75% of Apple’s iPhones destined for the U.S. market were assembled in India, a complete reversal from just a year ago, when just more than 15% of iPhones sold in the US were Indian-made.

The shift toward India is not limited to Apple. Motorola’s share of smartphone manufactured in India grew from just 1% in Q2 2024 to 35% in Q2 2025. Samsung is also making a slight push in India, although mainly for its A-series devices. Around 5% of Samsung devices sold in the U.S. in Q2 2025 were manufactured in India, 5% in South Korea and 90% in Vietnam.

For vendors lacking this diversification, such as TCL, the challenges posed by new tariffs will have to be faced head-on, with fewer options to adjust, as changing a supply chain is a costly and time-demanding process.

Investing in the U.S. for future resilience

Beyond international reorientation and inventory build-up, vendors are demonstrating commitment to the U.S. and the new administration’s goals. Here, vendors seek investments that make logical sense from a cost and skillset view to minimize the added cost and maximize the existing capabilities of U.S.-based suppliers and skillsets.

Apple, for instance, has increased its commitment by US$600 billion, which includes moving parts of its supply chain to the U.S. and expanding partnerships with its U.S. suppliers. Apple has shown commitment, for example, by being the largest customer of TSMC in Arizona and having cover glasses for all iPhones and Apple Watches made in Kentucky, going forward with Corning.

While a full-scale assembly move is unlikely, if not impossible, due to its highly impractical and costly nature, these investments are powerful statements and tactics to build resilience. It is natural to expect other vendors to follow suit.

The road ahead

With tariff policy uncertainty likely to settle down for now, the industry has entered a period of relative stability. Vendors will need to adjust, fine-tune inventories, find the sweet spot between different assembly locations and find the right investments and opportunities to target in the U.S. This is a period of ongoing adjustment and we will continue to see disruptions in the shipment numbers in the upcoming quarters. It still remains a question of whether smartphones will continue to be exempt from tariffs or what the overall impact on consumer spending, and consequently smartphone demand, may become.

Still, vendors cannot afford to lose track of what matters most. Bringing attractive products and solutions to market that continue to capture consumers’ attention and imagination is more important than ever before, particularly as the biggest innovation leaps have become software-focused and incremental.

H1 2025 is also a golden example of how important the supply chain resiliency lessons that were learned during the pandemic were. In a world where shocks are inevitable, resilience might be seen as a long-term defensive measure, but when it matters, it is a competitive edge.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions