2024 has been a year of unprecedented changes in the polarizer supply landscape. Early in the year, the market was concerned about an oversupply due to increased investments in production capacity while demand fell short of expectations. However, as new investments were repeatedly postponed, and existing production lines were restructured, the polarizer industry has now found itself facing a supply shortage. We explore further in our latest blog.

On December 24, 2024, Sumitomo Chemical announced it would sell its polarizer production and chip-cut processing lines in China to Chinese polarizer manufacturer Sunnypol. This decision came just one quarter after SDI sold its polarizer division to a Chinese company in September 2024.

Initially, Sumitomo had planned to include its Japanese and South Korean production lines in the sale. This raises questions about why these lines were ultimately excluded from the deal. With most polarizer production now shifting to China, it seems unlikely that demand will be sufficient to sustain the operation of these lines. As a result, the polarizer industry is closely watching what Sumitomo will decide to do with these remaining production lines.

Meanwhile, Sunnypol, had previously planned four new investments before acquiring Sumitomo’s production lines. It is now likely that the acquired lines will replace some of the planned investments, leading to cancellations or delays of Sunnypol’s earlier plans.

Shanjin, another key player, has postponed several planned investment projects and shut down some lines to improve production efficiency at each site. With slow demand in 4Q24 and sufficient capacity based on previous forecasts, most polarizer makers have changed focus to maximizing the efficiency of existing lines rather than pursuing further expansion.

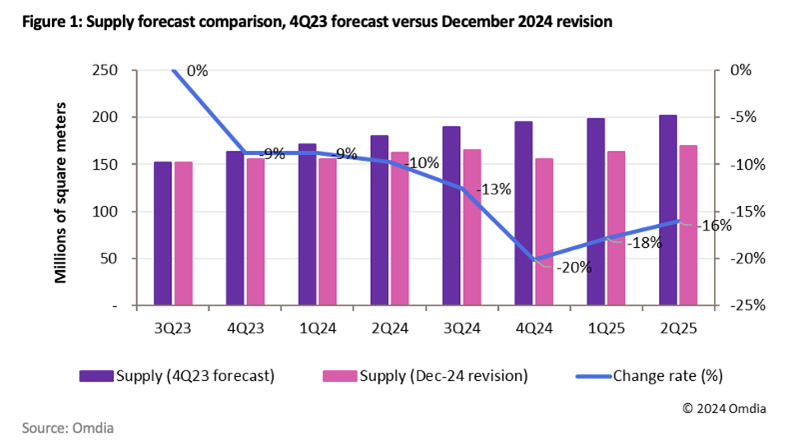

Figure 1 below compares the capacity in the 4Q23 forecast and the December 2024 revision. The polarizer capacity forecast for 3Q24 was reduced by 13% while the 4Q24 and 1Q25 forecasts were reduced by 20% and 18%, respectively.

Polarizer supply and demand forecast

Figure 2 shows the demand/supply of polarizers based on the revised capacity forecast. Based on the 4Q23 forecast, the market expected to see an oversupply of 18% in 4Q24 and 25% in 1Q25. However, the updated December 2024 forecast now predicts a tight supply situation, with 5% in 4Q24 and 7% in 1Q25.

Additionally, recent comments from US President-elect Donald Trump regarding tariffs have led to a surge in polarizer demand, exacerbating supply tightness. Initially, polarizer demand in 2H24 was expected to be sluggish, as some demand had been shifted to the first half of the year. Polarizer and subfilm manufacturers did not expect such a surge in demand, and some subfilm manufacturers were slow to respond, as they planned for maintenance in 4Q24. As a result, the supply tightness has worsened, leaving polarizer and subfilm manufacturers racing to fulfill unexpected orders.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions