Omdia view

Joe Biden has won the US presidential election and his administration’s policies are expected to result in a big swing in fortunes for segments of the US industrial sector. There are short- and long-term implications for the US economy, with Biden promoting some drastically different policies from those advanced by President Donald Trump.

The economic policies of the Trump administration have had an impact on the industrial and manufacturing market in the US. The main policies under the Trump administration from 2017 to 2020 include the following:

- Tax reform: The Tax Cuts and Jobs Act of 2017 (TCJA) reduced corporate taxes from 35% to 21%. The goal was to increase capital investment and enhance the competitiveness of enterprises, thus increasing investment in manufacturing facilities and boosting small businesses.

- US Priority Energy Program: The focus was on supporting traditional energy industries such as coal, oil, and natural gas. It introduced a series of measures to maximize the use of domestic energy in the US and promoting economic development. It led to increases in industries such as mining, oil and gas, and power generation.

- De-globalization: The Trump administration implemented trade protectionism and encouraged American manufacturing companies to return to local production to reshape the domestic manufacturing industry.

- Trade policy and tariffs: Adding to ongoing US-China trade frictions, the Trump administration imposed tariffs on $7.5 billion in European exports annually, which created uncertainty that affected global trade. This uncertainty has reduced demand for machinery in most industries, but cargo vessels, ship building, and cranes and hoists have been particularly affected.

US market outlook

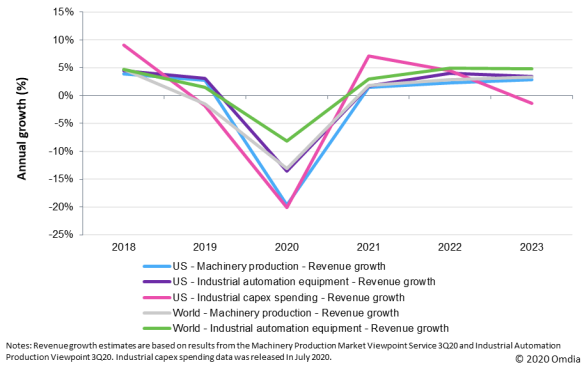

Source: Omdia

According to the Omdia Machinery Production Market Viewpoint Service (3Q) and the Industrial Automation Equipment Viewpoint Service (3Q), the US accounted for more than 16% and 18% of the global machinery production and automation equipment markets, respectively. Although not the biggest industrial producer, the US has occupied an important position in the global market since World War II, and its industrial policies have a profound impact on markets around the world.

Omdia has undertaken a comprehensive analysis of what the Biden presidency may look like and how it will impact industrial markets in the US.

Trade and tariffs

The Trump administration has used trade and tariffs strategically in a bid to boost investment and growth in the US. However, its aggressive stance has resulted in retaliation that could hinder the US economy. For example, the US recently imposed tariffs on EU steel and aluminum and threatened punitive duties on cars. In response, the EU announced it would impose tariffs on up to $4 billion worth of US goods and services in response to illegal aid for plane maker Boeing, but it expressed hope that trade ties would improve once Biden enters the White House.

Trump’s two-year Sino-US trade war has affected the US manufacturing sector. Biden is not in favor of Trump's increase of tariffs to resolve Sino-US trade relations. Instead, he advocates using trade laws to resolve disputes. This is expected to ease frictions between the US and China. This more cooperative approach to trade could provide global benefits, but whether tariffs will be abolished remains to be seen.

Biden has suggested that his administration will strengthen cooperation with allies to win the initiative in trade and be more moderate in trade policy. This is particularly beneficial for industries that are highly dependent on international trade, such as machinery, chemicals, metals, and mining.

The "Build Back Better" policy proposed by Biden is more moderate than the "America First, Make America Strong Again" policy imposed during the Trump era. In today's world, with global integration and the deep integration of supply chains, Trump's policies are too radical. Biden's policy advocates ensuring the interests of the US through global cooperation, which will be more conducive to maximizing the interests of the country's manufacturing industry.

Transformative technology drives manufacturing change

Biden has proposed investing US$300 billion in research on transformative technologies such as artificial intelligence, electric vehicles, and 5G to ensure that the US maintains its lead in the high-tech field. The policy proposes a "Made in all of America" program, dedicated to helping high value-added manufacturing and innovation fields.

If the policy can be implemented smoothly, it will inject new growth momentum into the domestic manufacturing industry in the US. This will drive growth in industries such as electronic manufacturing, automotive manufacturing, semiconductor manufacturing, and communication industries. Additionally, the penetration of transformative technologies, such as 5G, into the automation market will bring new development opportunities for automation vendors.

Strengthen strategic industries

The COVID-19 pandemic not only hit the US manufacturing industry hard, but also exposed supply chain problems in key industries, such as an over-reliance on automotive components from Mexico. If the Mexican auto part factories cannot resume work, then the US auto factories will not be able to operate normally because of a shortage of parts. As a result, rebuilding and strengthening domestic key industry projects have become important goals for the US to reduce reliance on other nations. Biden plans to encourage US manufacturers to return to the US for production through incentive schemes and tax reform.

Investment is likely to be focused on some key industries over the next few years, including energy, power grid technology, semiconductors, electronics, and raw materials manufacturing. Incentives will drive the development of these industries, thereby driving growth of demand for related machinery and automation products.

For example, Biden proposes supporting electric vehicle manufacturing through US$400 billion of investment in automobile infrastructure and working with individual states to develop stricter emission standards for internal combustion engines. This is obviously good news for new energy vehicle manufacturers, but it will be a problem for manufacturers of traditional energy vehicles, whose market share is being eroded by new energy vehicles. This policy will cause more investment to flow into the field of new energy vehicles, driving increased investment in new manufacturing equipment and demand for automation products in this field. However, demand for equipment and automation products in the field of traditional energy vehicles will shrink.

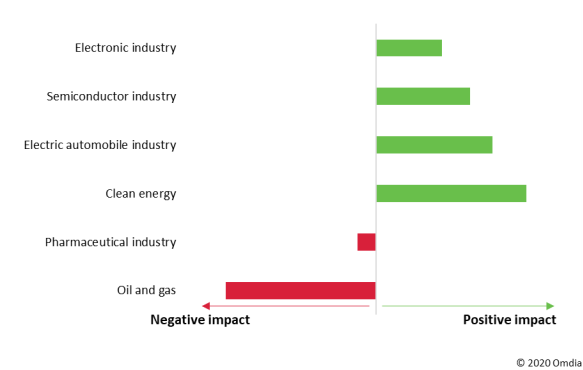

The pharmaceutical industry could suffer under Biden, with prospects still unclear. In a speech on health care, Biden said he will “stop uncontrolled drug prices and the huge profits of the pharmaceutical industry.” If such policies are implemented, the decline in drug prices will affect the profits of pharmaceutical companies and weaken investment enthusiasm and confidence for the pharmaceutical industry, ultimately affecting investment in new equipment.

Taxation brings manufacturing back to the US

One of Donald Trump’s first actions as president was to introduce the TCJA of 2017, which reduced corporate taxes from 35% to 21%. This was widely credited with boosting investment in the US and helping smaller businesses to grow.

Biden plans to increase the domestic tax rate by 8%, which will likely have a negative impact on business investment in the short-term. He has also proposed doubling the tax on profits from overseas branches from 10.5% to 21%. However, he has proposed a 10% tax credit for companies that invest in facilities that are closed or close to closing, retrofitting or expanding facilities, and bringing production or services back to the US. In addition, Biden has proposed a 10% surtax on companies that manufacture overseas. This should level out the changes, ensuring that it is still better for companies to manufacture in the US, rather than overseas, from a taxation viewpoint.

It could also create new market opportunities within the US. The construction and commissioning of the new factories is bound to drive further demand for new equipment and capital investment, which will increase demand for automation equipment.

Winner and loser industries under Biden's policy

Source: Omdia

Revitalizing the energy industry

Fostering the clean energy revolution is another of Biden’s policies to revitalize American manufacturing. Biden has proposed investment of hundreds of millions of dollars into research and development of new technologies and clean energy. The aim is to achieve zero net carbon emissions in the US by 2050.

Biden's energy policy is bound to change the landscape of energy investment in the US over the next few years. The new energy market will gain more attention than traditional energy markets (oil and gas) and boost opportunities for machinery and automation equipment in these areas.

However, those traditional energy sources will likely lose investment. The US is a large producer and consumer of oil, and Biden's energy policy could have a detrimental impact on the US economy. Many long-term oil and gas projects have struggled for funding since oil prices started declining in 2014, while the shale industry is capital intensive and highly indebted. The pandemic has had a significant impact on demand for oil and gas, putting oil producers and prices under additional pressure from an oversupply. A shift in focus toward new energy will further erode the market for traditional energy, hindering the recovery of the oil industry in the US.

Overall, there are many differences between the Trump and Biden policies. Under Biden, the US is expected to become more environmentally conscious, repair damaged international relationships, and drive investment in technologies of the future. However, both their policies aim to make the US stronger and a world leader in manufacturing and technology. There will be winners and losers along the way, but Biden’s “Made in all of America” plan will provide favorable conditions for a recovery in the US machinery production and automation equipment markets.

Appendix

Methodology

Further reading

Author

Lisa Wang, Analyst, Manufacturing Technology