Three key elements are changing the automotive industry, driving it toward a new mobility era, a survey by Wards Intelligence shows:

- New business models and profit pools.

- Hardware revolution and centralization.

-

Software-defined vehicles driven by data.

In this first article of a series of three, we will look at the impact the software-defined vehicle will have on the industry’s business model, supply chain and operating processes. (Complete survey results can be downloaded via the link at the top of this article.)

Without a doubt, the automotive industry in moving into a new and disruptive mobility era encompassing a much broader, interconnected ecosystem that is continually creating and sharing huge amounts of valuable data across domains.

The metamorphosis to new mindsets and strategies and the growing need for new competences in software and data, together with the urgency to contain development costs, are impacting each OEM’s operating processes and business models, as well as introducing opportunities to tap into alternative profit pools.

The transformation goes far beyond the vehicle itself, however. Also playing disruptive roles in reshaping operations along the entire automotive value chain are cloud and datacenters, the OEM’s backend infrastructure and the emergence of smart mobility services and the technology around the Internet of Things connectivity.

Wards Intelligence believes the business opportunities driven by the transformation expected to occur over the next 10 years will introduce several billion dollars in revenue to the mobility market. As Figure 1 and Figure 2 show, the profit opportunities for OEMs clearly indicate two major components:

-

Optimization of the cost structure required to design, manufacture and maintain future fleets of vehicles both in the backend operations and surrounding infrastructure.

-

New revenue streams and cost reductions derived from in-vehicle services and more advanced vehicle electric/electronic architectures.

Figure 1

Figure 2

Meanwhile, these new E/E platforms, advanced autonomous-driving features, sensors, software platforms and the increasingly connected infrastructure that are driving the change require the introduction of new components and a cultivation of new expertise within the industry to tap into these unexplored and unknown domains. Hence, startups and experts in these new domains outside the traditional auto industry are gaining importance and threatening the market share of the legacy OEMs.

ADJACENT MARKETS AND INDUSTRY DOMAINS

New mobility concepts are resulting in a more complex ecosystem comprised of several heterogeneous domains with which vehicles interact.

For example, public cloud and on-premise datacenters are needed to support OEM backend operations, R&D efforts and advanced manufacturing plants. Intelligent Transportation Systems (ITS), Smart Grid, Smart City and Smart Home are just a few of the other industry domains that will overlap in both function and market application with the future concepts of mobility and connected services.

Data, the connection between these various domains and IoT industry segments, already is well recognized to be the new profit center. Unlike in the past though, it will be collected, structured, elaborated and shared to create additional value in a non-linear manner across such domains.

To achieve this target, new architectural approaches are required inside and outside the vehicle.

As highlighted by the Wards Intelligence research on future vehicle architectures, the automotive supply chain – and, in particular, vehicle manufacturers – are focusing efforts on developing futureproof and flexible E/E architectures that can adjust easily to accommodate the new features and requirements of next-generation vehicles.

Futureproofing also will ensure OEMs will perform updates during a vehicle’s lifetime, avoiding obsolescence and ensuring a relevant user experience when compared with faster-moving adjacent industries such as information technology and consumer electronics.

In futureproofing vehicle architectures, a divergence from the traditional monolithic piece of software is expected to be a priority. The target is to abandon monolithic software programs with tens of millions of lines of code. As a result, Service Oriented Architectures (SOAs) are expected to be the basis of future software-defined vehicles, implementing a modular approach to services and applications, similar to what has been used for decades in the IT industry.

In-vehicle system architectures are not the only aspect to consider, however. A well-geared and constructed backend infrastructure also is essential for OEMs to take full advantage of digitalization. Vehicle manufactures aim to control – end-to-end – the entire automotive business, from design, manufacturing, testing, validation, final assembly and certification to maintenance, software updating, app development and deployment of mobility services during the lifetime of a vehicle.

A separate and secure backend environment consequently is essential to maintaining that control and ownership of the most important elements of the automotive business sector in the future: data and software.

Moreover, to achieve real agility in the vehicle-design cycle, both automakers and upper-tier suppliers will need to change their mindsets to promote design flexibility and speed of innovation. Beyond physical hardware, OEMs need to build competence quickly around software development and data analytics by growing skills in-house or securing reliable partners.

Table 1 summarizes the key areas of disruption at different levels in the mobility ecosystem.

Table 1

SUPPLY CHAIN AND ECO-SYSTEM IMPACT

As an obvious consequence, the entire automotive supply chain is affected by each of the changes indicated above. Collaboration across the supply chain – to share technology, know-how and costs – is the clear path that all the automotive players and technology vendors – from incumbents to new automakers and suppliers – are following.

The outlook for the automotive sector is extremely positive, though quite dynamic. New business models ranging from service providers to data collection and other monetization opportunities will offer new and appealing revenue streams. Traditional automotive players need to adjust quickly by defining partnerships, expanding their vertical integration through acquisition and/or cultivating new competencies internally, mainly around software development. This is a must, if traditional automotive players are to maintain share and relevancy in this fluid market.

The development of a reliable and complete ecosystem is key to future success, both within the vehicle itself and beyond. Again, automotive no longer is simply the small world defined by the vehicle chassis; vehicles now will be part of a complex IoT environment spanning from design and manufacturing to sales and service, with the external infrastructure for data, software and services and the smart grid and city playing key roles. In other words, vehicles are becoming “ultra-connected.”

It also is evident the automotive revolution is not affecting only vehicle manufacturers. It extends to the bottom of the supply chain. Many semiconductor suppliers are the key technology enablers supporting the rapid pace of development in new automotive applications. Several semiconductor suppliers have moved up the supply chain, transforming themselves into system integrators and interacting directly with vehicle OEMs to identify and develop a well-aligned technology roadmap for years to come.

In fact, similar to OEMs, technology suppliers are struggling against increased complexity and skyrocketing costs. Even at the bottom of the supply chain, a basic change in strategy is required to limit or share costs and, thus, maximize return on investment.

The high cost of developing new silicon devices, with the most advanced technology nodes, needs to be shared across a variety of market segments. To develop components just for the niche automotive market no longer is practical. The same automotive or industrial solutions need to be re-usable in other domains and markets with minor adjustments only, if reasonable RoI is to be maintained.

NEW BUSINESS MODELS AND PROFIT POOLS

An expanded ecosystem, new software-based architectures and broadly deployed connectivity, as well as the ability to identify and monetize data are impacting the OEM business model and profit pool in a big way. The automotive market beyond 2030 will appear quite different from today, as will the operating strategies of vehicle manufacturers.

Software-defined vehicles and “functionality as a service” are driving and will continue to drive new revenue streams even more so in the future, as well as provide cost-reduction opportunities along the entire automotive value chain.

Three major business areas where automotive players will focus their innovation effort to increase profit and revenue in the new mobility era:

-

Direct Revenue Streams: a) B2(B2)C: Selling products, features, upgrades to customers; b) B2B: Selling vehicle/driver data for tailored advertising/product recommendations; c) New services.

-

Cost Reduction: a) Predictive maintenance; b) Diagnosis and feedback to R&D for optimization; c) Cost of repair; d) Optimization of fleet operations; e) Insurance and warranty; f) Retailer Footprint and Inventory.

-

Brand Differentiation and Added Value services: a) CRM and loyalty programs; b) Optimized HMI and Setting; c) Security and Safety.

But such essential new roles for software components also demand the development of a more efficient and flexible infrastructure in the automotive industry, impacting servers, storage equipment and connectivity, both in R&D and manufacturing.

The way industrial products are designed, manufactured and maintained is evolving as a result of changes brought on by both macroeconomic trends and emerging technologies. The effort to reign in skyrocketing costs through innovation also plays a role in the design and manufacturing evolution.

The abrupt change in business models will shift the profit pool in new directions. The industry will direct revenue streams away from the traditional model of selling vehicles and components and toward approaches such as vehicle as a service – or even mobility as a service – over the next decade as the evolution to autonomy, connectivity, electrification and mobility continues.

DESIGNING, MANUFACTURING AND DELIVERING VEHICLES

Automotive backend and front-end operations are merging thanks to connectivity. New applications are being developed around software, data and other advanced technology such as artificial intelligence and robotics.

Automakers are particularly bullish about their progress toward Industry 4.0, with robotically assisted manufacturing, production-line simulation, big-data quality control and autonomous logistics vehicles. In average suppliers appear less engaged overall, although even here there are clear indications of change, as in the case of the new product-development organization at Bosch and similar moves at rival ZF, among others.

Predictive maintenance as well as big-data quality and control are the obvious areas in which the automotive industry is heavily investing, together with robotics and the supply chain. The era of data analytics and AI technology is recognized across the globe to be essential to make huge leaps in efficiency and throughput across several areas and applications and move toward full digitalization.

Predictive maintenance, testing and simulation, quality control, autonomous machines/robotics, inventory management, equipment inspection and process control are affecting the automotive industry as well as every other domain, striving for higher efficiency and cost reduction.

Contradicting the past, the enormous amount of available data now passes through a lengthy process of labeling and tagging, data structuring, processing and data management.

An essential component of future industrial and automation domains is the integration of all the above data-based functionalities into a digital replica of manufacturing premises and systems to enable data-driven engineering, production, and maintenance decisions – the digital twin.

SOFTWARE-DEFINED BUT DATA-DRIVEN PROFITS

The automotive industry is confident that data is the potential gold mine that will trigger new revenue streams and high-margin business models.

Technology and infrastructure are, or will be, available to take advantage of the “hidden” value in the data. The industry is focusing on four key elements:

-

Connectivity: the basic precondition to share data.

-

The human-machine interface (HMI) and software platform: the enabler to uniformly collect data.

-

Artificial Intelligence: identifying the value in the data.

-

Cloud and datacenter: the required infrastructure for storage and data processing

Once the above infrastructure elements are established, data can disrupt and significantly enhance operations throughout an entire industry, boosting productivity and process optimization while reducing development and manufacturing costs. Data-driven application and monetization are in the line of fire of the entire automotive value chain that is trying to identify best opportunities in value creation offered by data analytics.

As Figure 3 shows, new use cases for monetization can be generated by a vast number of permutations among data type, data usage and data user classes. Automakers and suppliers already sit on a huge mountain of data. The challenge is to structure this data and allow analytics and AI algorithms to extract the value. This is the most critical aspect for the industry to succeed.

Figure 3

In the Wards Intelligence survey, a majority of OEM respondents view their positioning as excellent when it comes to “Validation and Vehicle Development” (60% of those responding) followed “Identifying Certification/Homologation” and “Diagnoses/Predictive maintenance” (40% each). Alternatively, suppliers rated their engagement in data strategy implementation low.

Among all respondents, the interest rating was below 30%.

The results could hint at a more favorable position for the OEMs in controlling and monetizing data generated by their fleets, rather than other automotive suppliers. Moreover, as shown in the Figure 4, although opinions on the domains and areas that are best suited for data monetization strategies vary between members of the supply chain, connectivity still registers the highest score, cited by 84% of survey respondents, followed by the opportunities to upgrade functionality during a vehicle’s lifetime. User experience, infotainment as a service and vehicle updates score similarly, taking third place in driving revenue based on subscription models. Rated surprisingly low are advanced driver-assistance system functions as a service, likely the effect of the slowdown in the race for fully autonomous vehicles in recent months.

Figure 4

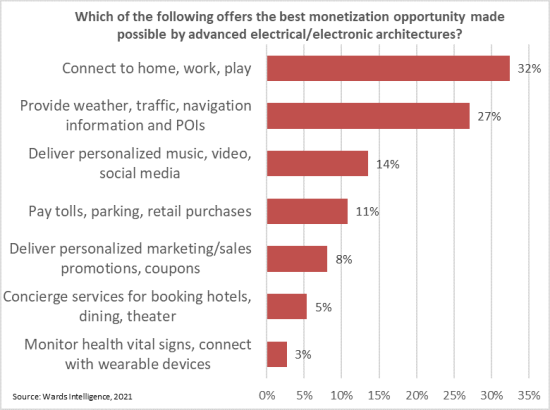

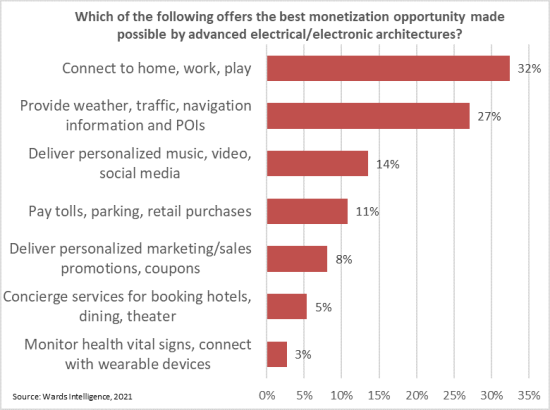

Figure 5 indicates the industry’s outlook on the best opportunities to monetize data, with connectivity and navigation and travel information clear leaders.

Furthermore, it is evident that the revolution occurring will not affect all automotive players in the same way. The graphic below shows respondents from OEMs and suppliers have quite scattered views as to whether their companies are pacesetters, followers or somewhere in-between. That uncertain view could be the result of the multitude of business factors and dynamics affecting such tactical and strategic decisions, including the fact that entire industry is undergoing consolidation and facing other competitive pressures at each level along the supply chain.

Figure 5

Among industry players, the trend toward digital mobility looks to be clear, although it is not as clear how to ride the new wave. On one side there are several new potential business models and profit pools opening up that will unlock monetization through services. On the other hand, there also is a need for significant investment to refresh the industry from the ground up and to technologically align the pace of innovation with other domains such as consumer electronics and the IT industry.

This dichotomy is evident in the quite balanced responses to the two questions posted in the survey around the best monetization opportunities from advanced E/E architectures and service-related subscription models.

Figure 6

Nevertheless, the level of engagement among “pacesetters,” “fast followers” and “the pack” looks different between automakers and suppliers (see the above Figure 6). It is reasonable that vehicle manufacturers are setting a faster pace of innovation, when compared to suppliers, because there is much more pressure on OEMs to transform their business as a result of competition from “disruptors” such as Tesla.

Moreover, although a differentiated attitude between players has been always present in the industry, the massive impact on cost and restructuring means it is likely the distance between pacesetters and followers will increase, because not all players will be able to afford the changes. The investment required will result in a sort of natural selection, as has happened already for Tier 1 suppliers, which will probably bring further consolidation to the industry.

However, as shown in the Figure 7, even though the transition to the new mobility era already looks to have been initiated, much appears still tactically and strategically unclear, and a good chunk of automakers and suppliers are anticipating, even beyond 2030, a limited impact on their core and traditional business model based purely on vehicle sales.

Figure 7

CONCLUSION

Many of the concerns along the automotive value chain in the still-early days toward this dramatic industry shift can be derived from the answers to the survey question on what the main ecosystem challenges are in the shift to new E/E architectures (see attached report for survey results). Topping the list are “policy and regulations” and the need to establish “win-win-type” alliances between automotive and non-automotive partners.

The latest slowdown of the run toward fully autonomous vehicles, due partly to the COVID-19 pandemic and, more directly, the widespread realization of the challenges still ahead to reaching Level 4 and Level 5 autonomy, further reinforces a hectic moment, driven more by risk-decisions.

However, the impact that such a revolution will have both inside and outside the vehicle – whether mid- or long-term – is clearly evident. Embracing the new vehicle software-defined architectures, as well as reforming backend operations and elements of the outside infrastructure, will offer new opportunity to increase profit along the entire supply chain.

Figure 8

As shown in Figure 8 by how the industry views the best profit opportunities as a result of next-gen E/E architectures, new models such as cooperation with non-traditional automotive companies, connectivity with other adjacent digital domains (IoT), greater efficiency of existing processes and control of end-to-end operations and reduce or share costs will lead the way.

Finally, data analytics customer-relationship management will allow automakers to continuously meet customer needs and requirements during vehicle lifetime and set the pace for future vehicle generation.

For more information and details please click on the "Download" button above this article to access the survey report: Wards Intelligence 2021 Software Defined Vehicles Survey - Business