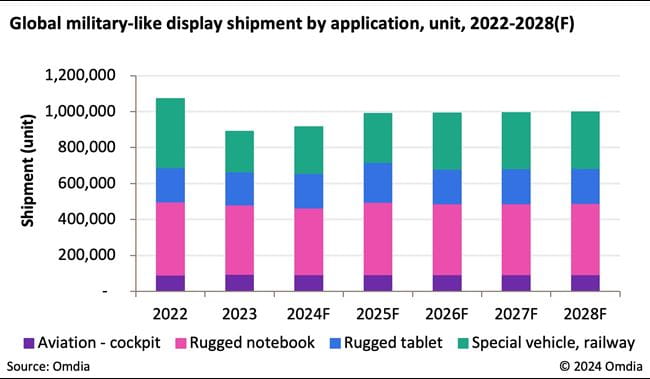

LONDON, October 15, 2024: According to Omdia's Industrial and Public Display & OEM Intelligence Service report, industrial displays are utilized across various vertical markets including gaming, human-machine interfaces, fitness, medical, smart retail, transportation, touch monitors, smart home and office, industrial, outdoor, rugged devices and others. Some of these products are specifically designed for military applications, such as aviation cockpit, rugged tablets, rugged notebooks, and specialized vehicles. With rising geopolitical concerns, global military-like display shipments are expected to reach 916,000 units in 2024, reflecting a 2.8% year-over-year (YoY) growth. By 2025, Omdia estimates shipments will grow to 989,000 units marking an 8% YoY growth and will stably reach the one-million-unit milestone by 2028.

There are over 50 types of industrial display applications, resulting in a wide and complex range. Panel makers often provide displays in various form factors tailored to specific applications, with a mix of competition and collaboration among panel makers, display module houses, and suppliers of cover glass and touch solutions. In 2024, Tianma and Innolux dominate the global military-like display market with 78% market share.

For aviation applications, which require over 10 years of stable supply, displays in the 3.1-inch to 7-inch range represent 40% shipment share, with Innolux being the primary panel maker. In rugged tablets and notebooks, the main display technology is a-Si, with 10.1-inch displays capturing 81% of rugged tablet shipment share in 2024, while 13.3-inch displays make up 77% shipment share for rugged notebooks predominantly supplied by Tianma with an 86% shipment share. Special vehicles require displays with high brightness, wide temperature operation and anti-vibration features; displays in the 3.1-inch to 7-inch range account for 54% shipment share, with Innolux supplying 66%. Due to recent conflicts, drones have become increasingly relevant in military displays recently. In addition to a 10.1-inch rugged tablet for remote drone control and a 15.6-inch dual-screen ground station, panel makers are offering open cells ranging from 5 to 7 inches to address cost concerns associated with drones.

“Global military-like displays are primarily supplied by Tianma, BOE, Innolux, AUO Display Plus (ADP) and Truly. Should geopolitical conflict arises, we may see supply chain restructuring that could affect future supply chain relationships,” said TzuYu Huang Principal Analyst, Large Area Display and Supply Chain, Omdia.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions