LONDON, July 31, 2025: According to the latest analysis from Omdia’s Automotive Display Intelligence Service, the global automotive display market is set to see strong growth in 2025 with display panel revenues projected to reach $13.6 billion an 8% year-over-year (YoY) increase. Omdia further forecasts that the market will grow to $18.3 billion by 2030.

This revenue growth is being driven not by unit volume but by the rising adoption of higher-end, and premium-priced display panel technologies specifically OLED (Organic Light-Emitting Diode) and LTPS (Low Temperature Poly Silicon) TFT LCD panels.

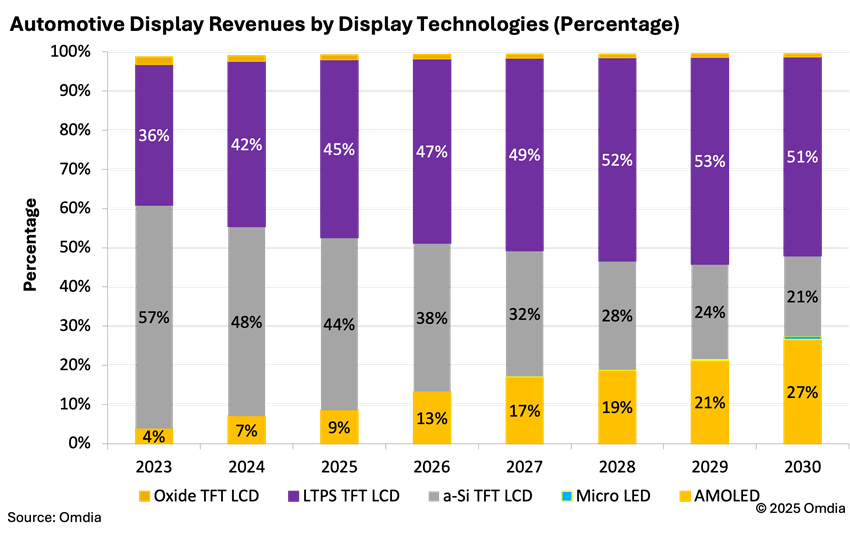

Based on panel shipment revenues, LTPS TFT LCD will account for 45% and OLED 9% of the total $13.6 billion automotive display market in 2025. In contrast, the revenue share of amorphous silicon (a-Si) TFT LCD panel will decline from 48% to 44%. 2025 will mark the first year that LTPS TFT LCD and OLED combined exceed 50% of total revenue, signaling a shift in the automotive display market toward higher value-added display technologies.

Compared with the traditional a-Si TFT LCD automotive display panels, LTPS TFT LCD offers several advantages, including higher resolution, greater brightness, lower power consumption, and enhanced touch panel integration. These benefits are especially important for the growing electric vehicle segment, where performance and efficiency are critical.

LTPS TFT LCD is seeing increased adoption in applications like center stack displays, instrument clusters and is dominating the head-up display (HUD) segment due to its brightness capabilities.

Meanwhile, OLED is gaining ground over LCD thanks to its thin and lightweight form factor, high contrast ratio, efficient power consumption, and support for free-form designs. OLED is expanding its presence across the center stack; instrument cluster and passenger displays.

Both LTPS TFT LCD and OLED are shipping at the higher average selling price (ASP) than traditional a-Si TFT LCD reinforcing the market’s shift toward high-value technologies.

Omdia forecasts that the LTPS TFT LCD will become the mainstream display technology in the automotive display market, with its shipment revenue share surpassing 50% by 2028. Meanwhile OLED is expected to dominate the high-end automobile cockpit segment with its shipment revenue share exceeding 20% in 2028. By 2030, the a-Si TFT LCD share is projected to decline significantly, dropping to 21% of total shipment revenue.

Looking further ahead, Omdia also expects transformable Micro LED display to enter the automotive display market after 2028 marking the next wave of advanced display technologies.

“While LTPS TFT LCD is retreating from the smartphone display market, panel makers such as AUO, BOE, ChinaStar, Japan Display, Innolux, Sharp, Tianma and LG Display are aggressively expanding into the automotive segment in pursuit of higher value and revenue, said David Hsieh, Senior Director for Display, Omdia.

“Conversely, as OLED continues to dominate in smartphones, leading OLED manufacturers like Samsung Display, LG Display and BOE are developing new tandem RGB OLED designs to accelerate their presence in the automotive space. The combination of display manufacturers innovation and intense OEM competition will be the key drivers of LTPS and OLED dominance in the automotive display market going forward.”

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions