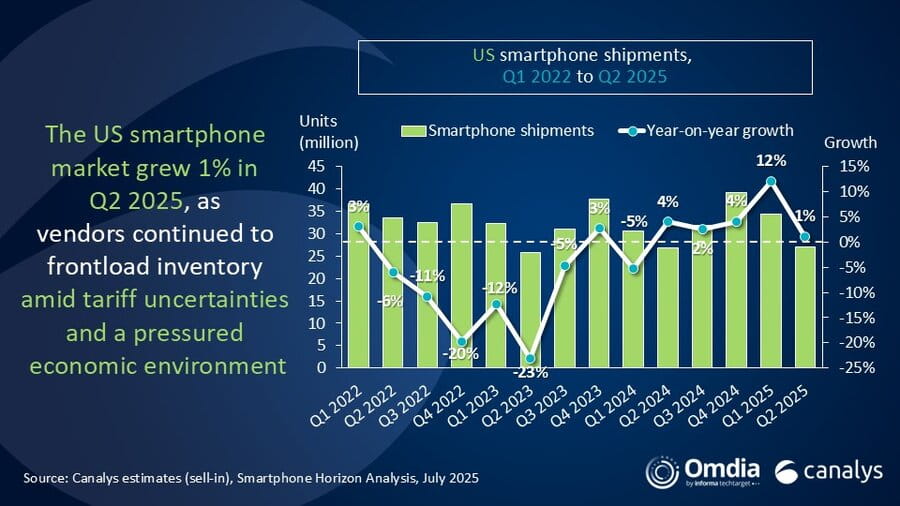

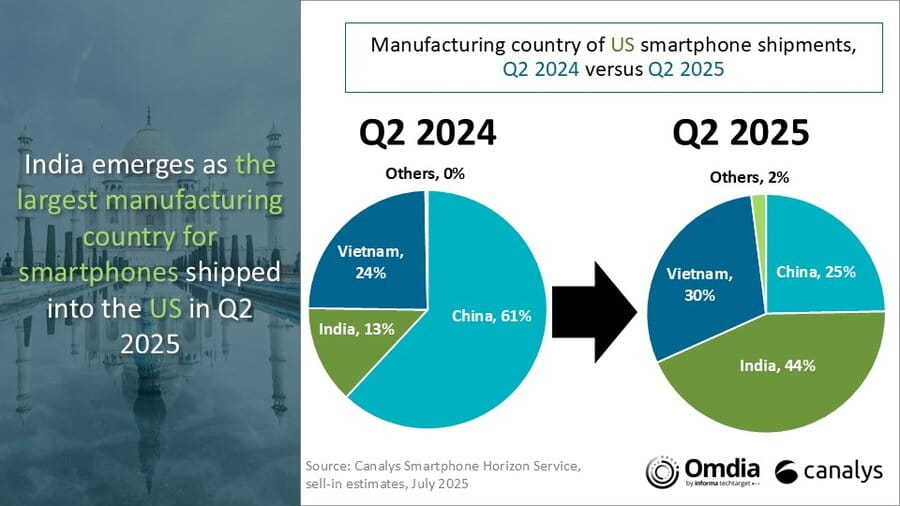

New research from Omdia reveals that United States smartphone shipments grew by 1% in Q2 2025 as vendors continued to frontload device inventories amid tariff concerns. The uncertain outcome of negotiations with China has accelerated supply chain reorientation. The share of US smartphone shipments assembled in China shrank from 61% in Q2 2024 to 25% in Q2 2025. Most of this decline has been picked up by India; the total volume of “Made-in-India” smartphones grew 240% year on year and now accounts for 44% of smartphones imported into the US, up from only 13% of smartphone shipments in Q2 2024.

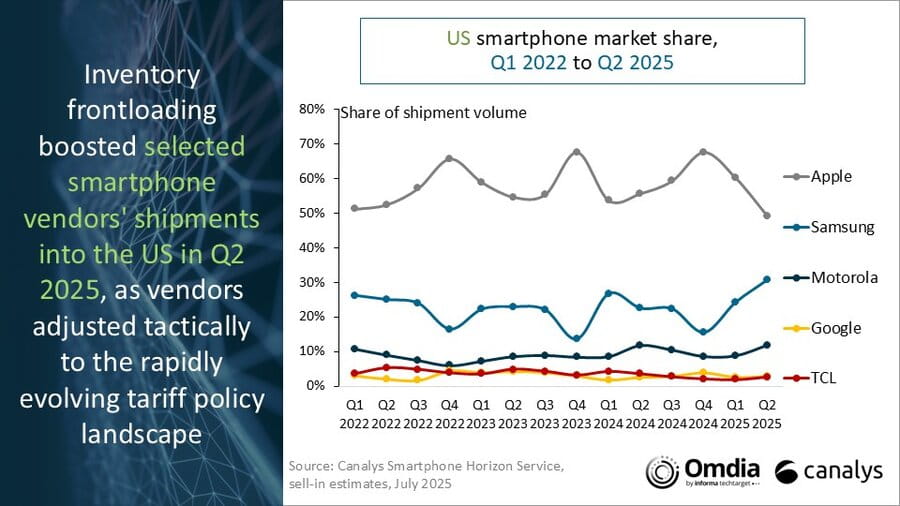

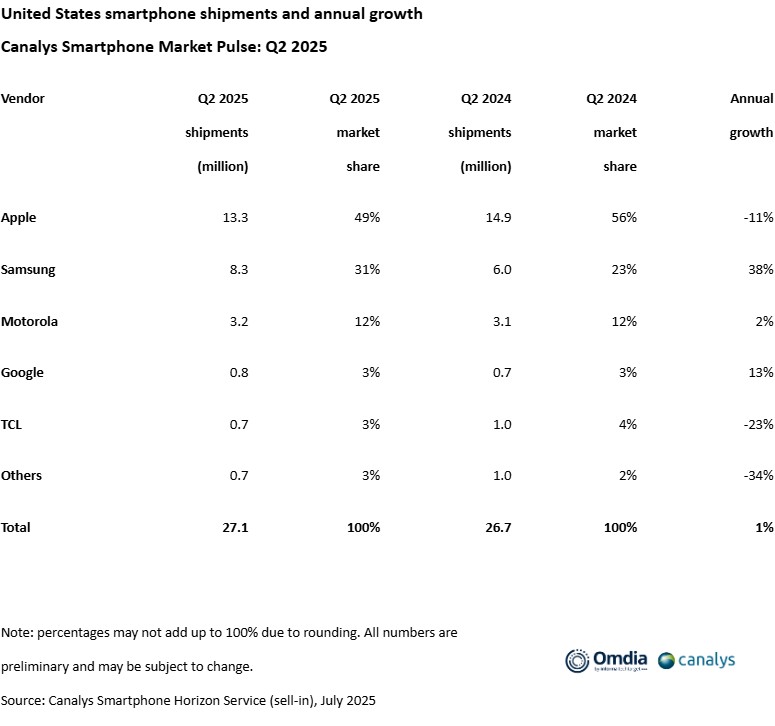

In Q2, iPhone shipments declined by 11% year on year to 13.3 million units, a correction from the 25% growth in Q1 2025. Samsung’s shipments grew 38% year over year to 8.3 million units. Motorola continued its expansion in the US, growing 2% to 3.2 million units. Google and TCL rounded off the top five, with Google growing 13% to 0.8 million while TCL declined 23%, shipping 0.7 million units.

Vendors accelerate manufacturing diversification amid shifting geopolitical landscape

“India became the leading manufacturing hub for smartphones sold in the US for the very first time in Q2 2025, largely driven by Apple’s accelerated supply chain shift to India amid an uncertain trade landscape between the US and China,” said Sanyam Chaurasia, Principal Analyst at Omdia. “Apple has scaled up its production capacity in India over the last several years as a part of its ‘China Plus One’ strategy and has opted to dedicate most of its export capacity in India to supply the US market so far in 2025. Apple has begun manufacturing and assembling Pro models of the iPhone 16 series in India, but is still dependent on established manufacturing bases in China for the scaled supply needed for Pro models in the US. Samsung and Motorola have also increased their share of US-targeted supply from India, although their shifts are significantly slower and smaller in scale than Apple’s. Motorola, similar to Apple, has its core manufacturing hub in China, whereas Samsung relies mainly upon producing its smartphones in Vietnam.”

Vendors frontload shipments to mitigate tariff risk

“Vendors continue to frontload devices and maintain high inventory levels to best cope with the risk of tariffs coming into play later in the year,” said Runar Bjorhovde, Senior Analyst at Omdia. “Apple built up its inventories rapidly toward the end of Q1 and sought to maintain this level in Q2. Samsung scaled up its inventory stock in Q2, boosting its shipments to grow 38% year on year, predominantly driven by Galaxy A-series devices. Yet, the market only grew 1% despite vendors frontloading inventory, indicating tepid demand in an increasingly pressured economic environment and a widening gap between sell-in and sell-through. Even if smartphones remain exempted from tariffs, many other categories are impacted, which might greatly impact consumers’ spending patterns and keep smartphone demand modest in H2.”

Scale-driven polarization intensifies as challengers struggle to justify US investment

“With the arrival of new requirements to local operations, uncertain tariff policies and pressured demand, it is becoming less attractive for mid-to-small-sized vendors to operate in the US, exemplified by HMD’s announcement to scale back its US operations,” added Bjorhovde. “Successful long-term strategies for smartphone vendors in the US require significant scale, but over 90% of the market is held by the three largest vendors. That leaves a very small opportunity for the remaining vendors, focused on prepaid carrier slots or non-carrier-driven channel strategies. Currently, OnePlus and Nothing are attempting non-carrier-focused strategies, focusing on their direct websites, BestBuy, Walmart and Amazon, but their current scale remains limited, and ambitions are dependent upon scale in other regions. Reducing the large investments required to be included in portfolios or finding new incentives for vendors to build their own brick-and-mortar stores could help improve the market’s attractiveness.”

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions