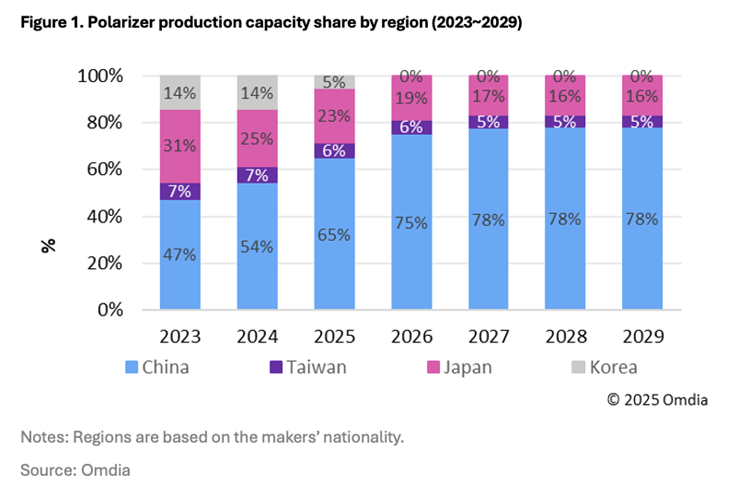

LONDON, June 13, 2025: Omdia’s latest Display Optical Film Market Tracker reveals that Chinese manufacturers accounted for 65% of global polarizer production capacity in 2024, a figure expected to approach 80% by 2027. This is largely driven by aggressive investment and strategic acquisitions by leading Chinese players such as Shanjin, HMO (Heongmei Optoelectronics), and Sunnypol and strong government backing for domestic supply chain localization.

With over 70% of global display panel production occurring in China in 2025, the relocation of the polarizer industry toward China represents a natural alignment of the supply chain.

However, this rapid consolidation has introduced new risks. “Despite sufficient total production capacity, some panel makers experienced polarizer shortages in early 2025,” stated Irene Heo, Principal Analyst in Omdia’s Display Research group. “Sudden changes in the supply chain caused these disruptions, as Chinese companies rapidly acquired polarizer and sub-film businesses.”

In one case, the acquisition of a major sub-film supplier by a competitor led to unforeseen delays in the procurement of critical sub-film materials.

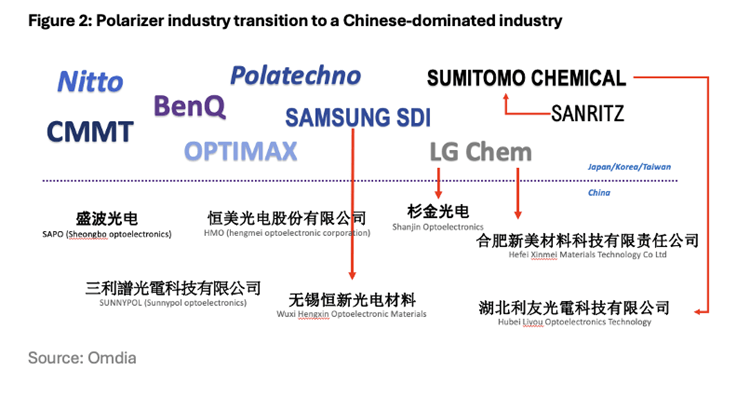

Figure 2 highlights the ongoing re-alignment of the FPD industry, with China emerging as the dominant force in the polarizer supply chain.

“Meanwhile, the remaining Korean and Japanese players are shifting their focus to high-value, differentiated products such as OLED polarizers and automotive-grade polarizer films. By leveraging advanced technology and engineering expertise, these firms aim to stay competitive in an increasingly evolving market,” added Heo.

Omdia’s Display Optical Film Market Tracker continues to monitor these industry changes, offering in-depth insights into mergers and acquisitions and analyzing the shifting dynamics across the polarizer supply chain.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions