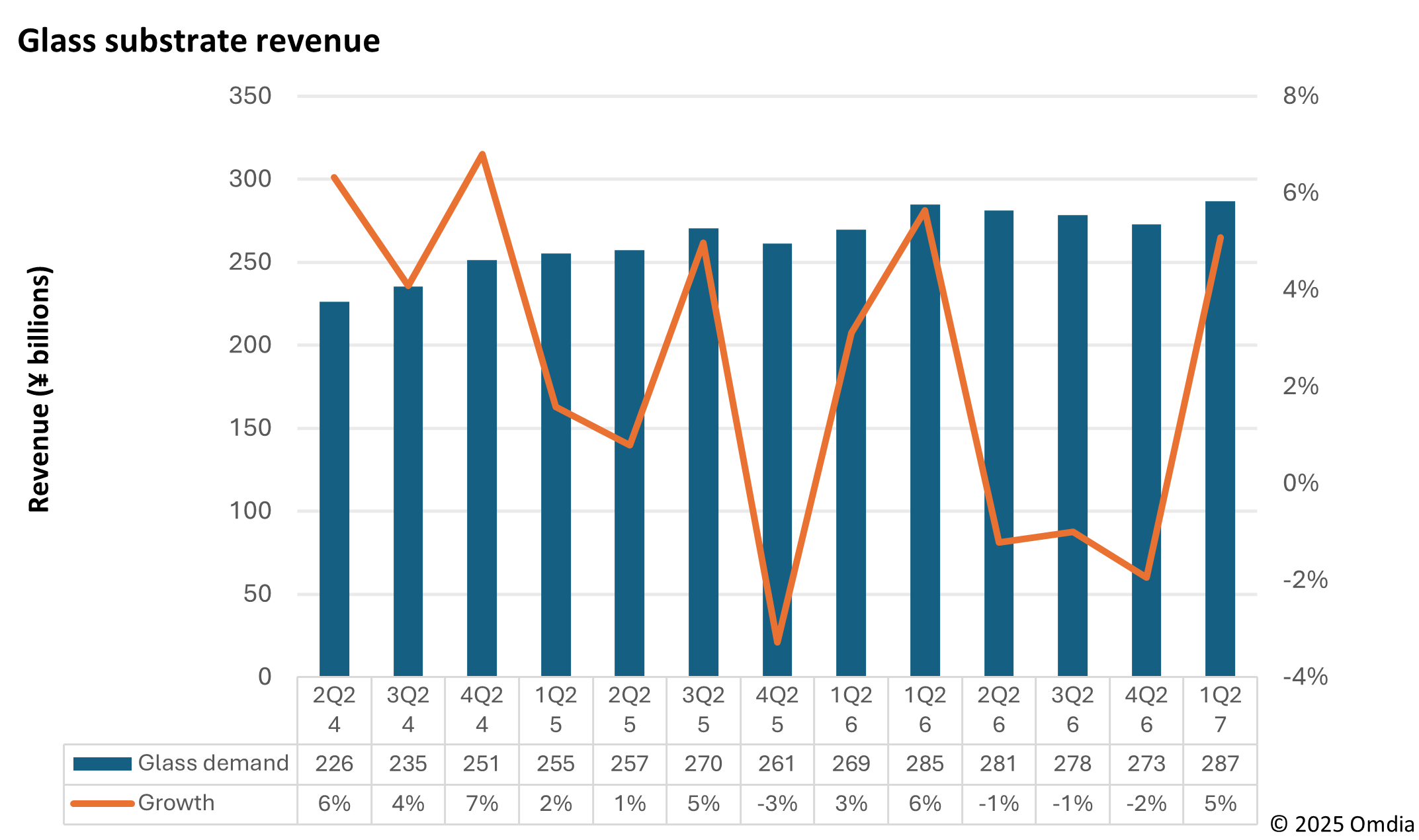

LONDON, November 5, 2025: Display glass revenue reached a record high of JPY 270 billion in the third quarter of 2025, driven by increases in both price and demand, according to new research from Omdia. This revenue represents a 5% quarter-over-quarter (QoQ) increase and 14% year-over-year (YoY) increase. Display glass is still traded in Japanese yen.

Strong revenue performance in 3Q25 reflects a significant strategic shift in the industry. After a severe recession in 2011, glass makers endured nearly a decade of intense competition from 2012 to 2022. During this period, major glass makers offered lower prices to panel makers to gain market share, with some reporting losses. Since 2022, the focus has shifted towards profitability. This has led makers to raise glass prices in both 2H23 and 2H24 with Corning leading the price increases in 2H23, and Corning and AGC leading in 2H24, followed by NEG. As a result, display glass prices have risen by more than 25% over two years.

In line with this focus on profitability, major glass makers are now managing glass production capacity to align with glass shipment. Before 2022, they maintained excess capacity. Glass production is a heavy industry; even minor incidents require a few months to recover a glass tank. Major glass makers are avoiding new glass tank investments, instead, focusing on increase the capacity of existing tanks through higher line speeds, improving production yield, and enhancing energy efficiency.

Meanwhile, Chinese glass makers continue to invest aggressively in glass tanks. These makers entered the display glass business around 2010with G5 glass production and now have a dominant market share in the G5 a-Si market. They are now investing in G8.5 glass tanks. While major glass makers currently maintain quality advantages, Chinese local glass makers are expected to catch up to the quality level in long-term mass production, likely increasing their G8.5 market share over the next five to ten years.

“As major glass makers may lose market share, their strategy appears to focus on generating profit now to fund future new business,” said Tadashi Uno, Research Manager at Omdia. “Major glass makers are developing new glass for the semiconductor industry and other sectors. New business areas include through glass via (TGV), semiconductor support glass, and hard disk substrate glass.”

The analysis and data in this release are from Omdia’s latest research, which provides detailed market tracking and forecasts for the display supply chain.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions