LONDON, November 17, 2025: New analysis from Omdia’s Tablet and Notebook Display and OEM Intelligence Service shows that OLED tablet panel shipments are expected to grow by 39% year-on-year (YoY) to 15 million units in 2026, after many years of lower-than-expected growth. These strong OLED targets are expected to be the main driver of overall tablet panel shipment growth next year.

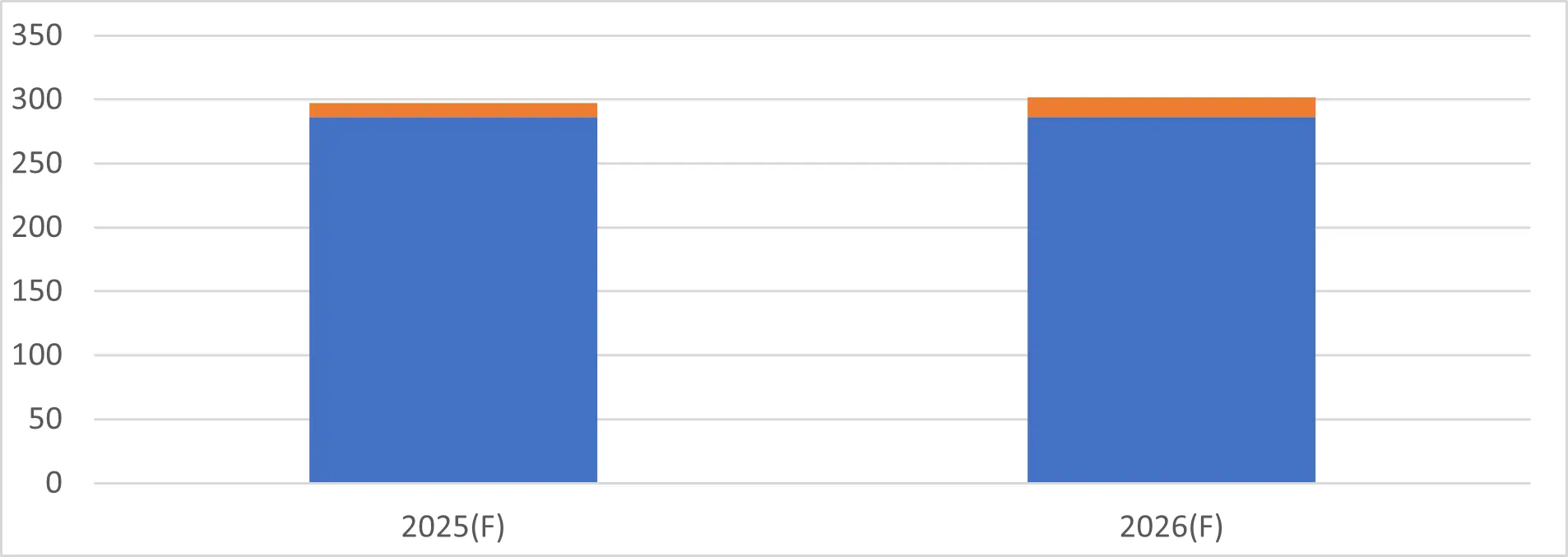

Looking ahead to 2026 overall, preliminary feedback from supply chain manufacturers shows a 1.4% YoY growth rate, with tablet panel shipments reaching 301.5 million units. By technology, LCD tablet panel shipments are projected at 286.4 million units in 2026, remaining at roughly the same shipment level as last year. While Chinese panel suppliers are still forecasting growth with domestic customers, suppliers focused on Apple or global tablet brands are taking a more conservative approach for 2026, given the excessively high shipment base in 2025.

“OLED tablet panel shipments are finally becoming the main engine of tablet panel growth,” said Linda Lin, Senior Principal Analyst at Omdia. “In 2026 we expect OLED shipments to grow 39% year-on-year to 15 million units, while LCD remains at roughly the same shipment level as 2025, so most of the incremental demand comes from OLED.”

Samsung Display’s higher shipment forecasts for the Apple iPad Pro and the new iPad mini, are expected to drive significant OLED growth in 2026. Chinese OLED tablet panel suppliers are also targeting higher volumes for both rigid and flexible OLED tablet panels next year. In particular, BOE, ChinaStar and Visionox are aiming at higher shipment targets for flexible OLED tablet panels to Huawei for 2026.

In 2025, tablet panel shipments are projected to reach 297.4 million units, up 8% YoY, based on the latest survey of downstream brands and OEM makers. This would not only represent the highest yearly volume to date but also mark the first time shipments approach 300 million units in a year. Strong demand from 1Q25 to 3Q25 has led Apple, Lenovo and Samsung to aggressively expand their market share in 2025.

In the past, tablet panels for other non-tablet applications typically accounted for around 50-55% of total tablet panel shipment in a year. In 2025, demand from those non-tablet applications may fall to less than 50% share, in line with top-tier tablet brands’ better-than-expected shipment performance.

By technology in 2025, LCD tablet panel shipments may reach 286.5 million units, up 8.3% YoY. while OLED tablet panel shipments are estimated to decline by 3.5% YoY in 2025 to just 10.9 million units, due to weaker demand in the high-end segment. Therefore, tablet panel shipment growth in 2025 is primarily driven by LCD technology. Chinese panel suppliers such as-BOE, ChinaStar, HKC Display and Tianma have been the most aggressive in expanding their share of supply to local tablet brands, such as Lenovo, Huawei, Honor, Xiaomi and others.

Omdia’s Tablet and Notebook Display and OEM Intelligence Service provides detailed tracking and forecasts of tablet and notebook panel shipments by technology, supplier and brand, helping industry participants understand demand trends and supply dynamics across the global display market.

Figure 1: Tablet panel shipment by display technology in 2025 and 2026 (million units)

Source: Omdia

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions