LONDON, October 29, 2025: Walmart’s acquisition of Vizio and the roll out of its proprietary operating system across the Onn. TV brand will propel CastOS to become the largest operating system by shipments in North America, according to new analysis from Omdia’s quarterly TV Design and Features Forecast tracker.

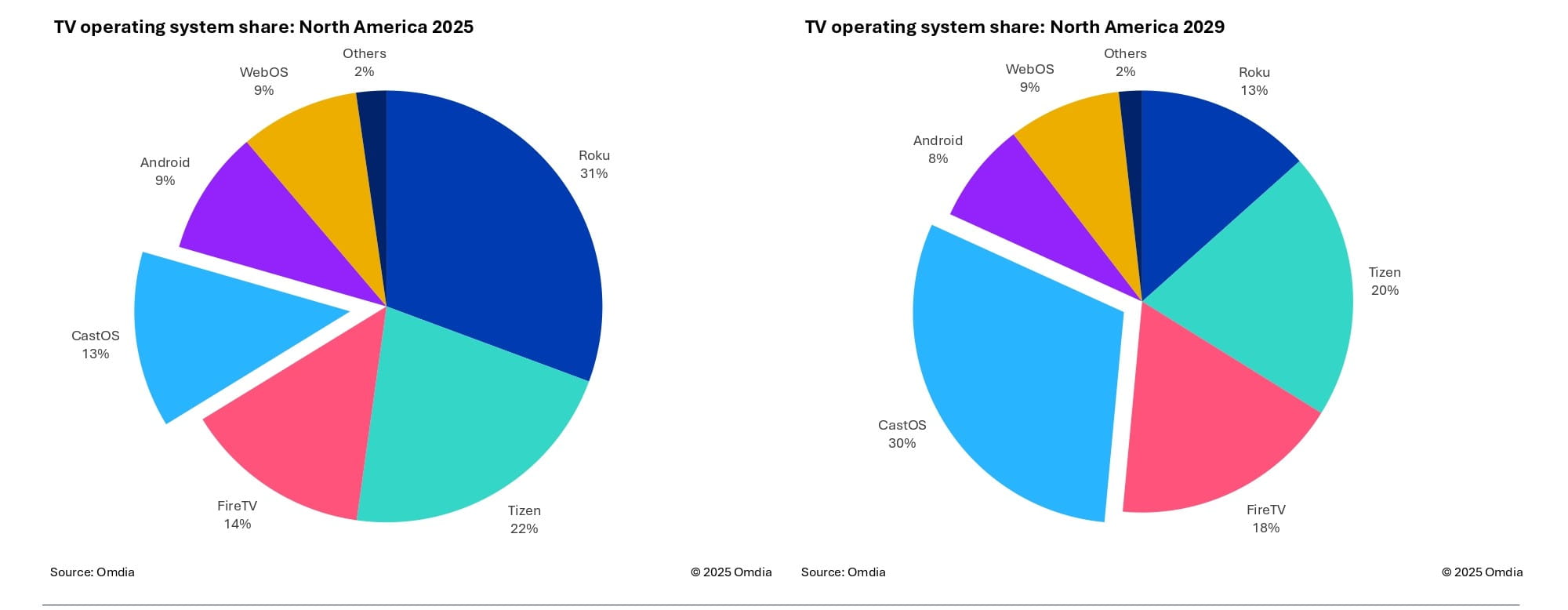

Omdia’s latest TV Sets Design and Features Market Tracker: Forecast – 2Q25, projects that CastOS shipments in North America will grow from 6.5 million units in 2025 to 15 million in 2029. This sharp increase in shipments of TVs carrying the operating system will leapfrog the platform ahead of Roku, Tizen and FireTV, all of which it trailed in 2025.

The unprecedented growth of CastOS shipments is a direct result of Walmart’s decision to shift the operating system of its in-house TV brand, Onn., from Roku to CastOS, a transition that will ramp-up over the next year. This strategic choice gives Walmart a substantial installed base of TVs, powered by a platform it owns, allowing the retailer to advertise directly to customers and enhance its e-commerce performance.

“Walmart’s decision to consolidate its TV platforms will give it a major asset that it can use not only to generate advertising revenue and sales growth, but also to compete more effectively with Amazon, which recently announced a collaboration with Roku to enable advertisers to launch campaigns across the combined installed base, via Amazon,” said Matthew Rubin, Principal Analyst, TV Set Research, Omdia. “Roku needs these kinds of partnerships, as it will inevitably lose shipment volume when it’s replaced as the pre-installed OS for Onn. TVs. However, this shift could prompt a reset in its international growth strategy.”

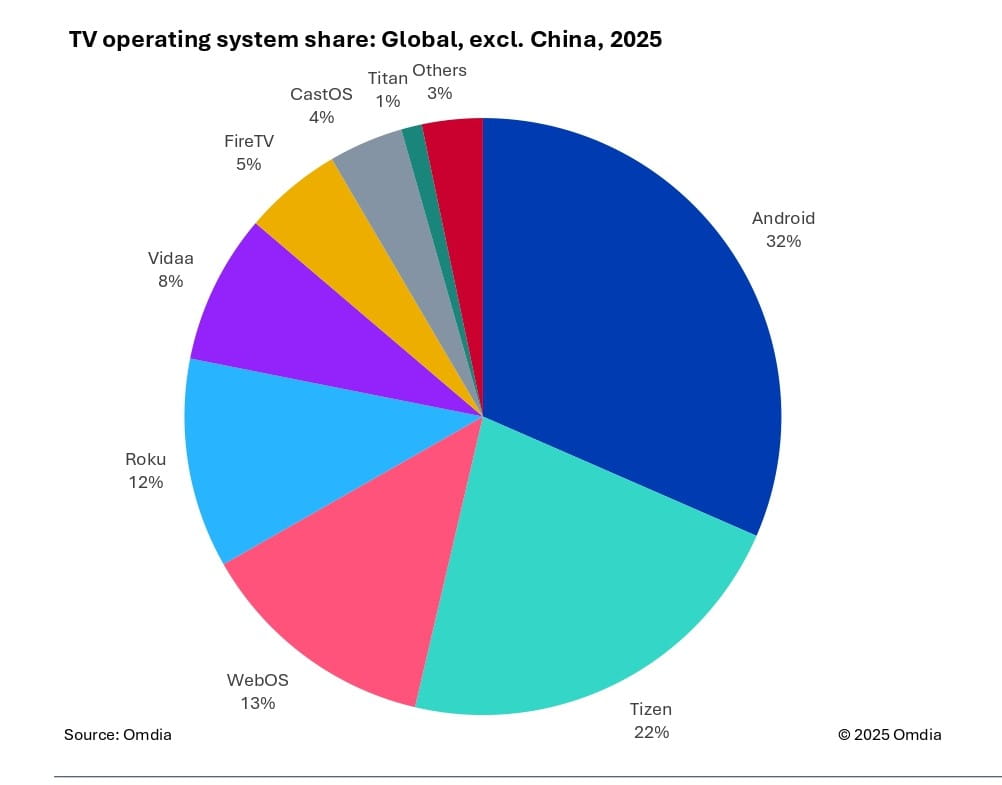

Globally, Android will remain the leading platform throughout the forecast period, decreasing slightly from 42% of shipments in 2025 to 39% in 2029. However, as this represents a disparate group of platforms using Android (including forked Android versions in China) it does not have the same consolidated reach as other platforms. Tizen is set to remain the second-largest TV operating system, though it is also expected to decline slightly from 17% market share in 2025 to 16% in 2029.

Beyond CastOS, the fastest-growing TV operating systems are expected to be Vidaa, rising from 6% in 2025 to nearly 8% in 2029, and Amazon’s Fire TV, increasing from 4% in 2025 to just over 5% in 2029.

Excluding China, the Android platform, which includes a larger proportion of Google TV, has a smaller market share, at 32% for 2025, but is nonetheless still the dominant platform. With Titan also set for growth, Omdia’s latest forecast highlights how the crowded operating system market, particularly in Europe, continues to offer opportunities for expansion. European-based retailers and platform providers are watching developments in North America closely, as a similar, retailer-led, consolidation strategy could emerge in the region in the coming years.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions