The latest development has changed what we watch, when and how we watch it, and the type of TV we buy. The first blog, part of a series of blogs focused on the television industry, Patrick Horner reviewed these shifts in detail. In his latest commentary, Patrick discusses the results of new Omdia research that shows how the move to connected TVs influences consumer purchasing decisions.

Consumers want the best smart TV experience

Late 2022, we asked more than 40,000 people across eight regions what they would look for when purchasing a new TV. For example, would it be the size of the screen, the operating system, the brand, the design, or its suitability for gaming that would influence their purchasing decision if they were to buy a new set in the next 12 months?

At the top of the list of drivers for respondents overall was the quality of the smart TV function, or quality of the operating system. More than 60% of people surveyed in Brazil and Mexico said this was the most important feature. Almost 50% of consumers in the United States (US) agreed.

Their response will have serious implications for the industry, including brands. How do you evaluate the quality of an operating system before you buy a TV? If you think about your own experience of visiting a retailer with the intention of purchasing a new device, you can easily assess the size of the screen and its design. Perhaps you can even see a difference in the quality of the images. But there’s currently no way for you to compare one brand’s operating system with another’s.

That means consumers can’t easily shop for the one feature they’re most interested in. So, why does that matter?

Engagement is key to success

Some companies in the US have identified new business models because of the shift to streaming content rather than watching traditional over-the-air channels or paying a subscription fee to watch cable television ad-free. Instead of making money from the sale of the TV at cost plus mark-up, they’re generating recurring revenue from advertising and viewing data, which means the hardware can be sold at very low margins. Roku, which is available in North America, Latin America and in some European countries, and VIZIO, which operates exclusively in the US, are leading the way with their approaches. Another company, Telly, is taking the idea a step further by offering consumers in the US a television for free.

With this business model, engagement is key to success. Companies make more money from advertising if viewers spend more of their time watching TV. One of the ways they can attract and retain people’s attention is with a well-designed and responsive operating system.

The operating system underpins the consumer experience

Several brands including Samsung and LG, and companies like Roku, VIZIO and Telly have their own operating systems. Others use Google’s Google TV. But Roku, along with Amazon and Apple, have made it easy for people to try their platform. They’ve developed smart media devices (SMDs) – relatively low-cost streaming devices that plug into any connected TV.

The Roku® Streaming Stick®, Amazon’s Fire TV Stick and Chromecast with Google TV enable people to interact with their operating system and content with very little risk involved in doing so. If viewers don’t like what they see, they can stop using the device and they will have wasted less than $50.

In comparison, if people invest in a new smart TV and find the operating system is hard to use or slow to respond they may be more frustrated. They’re unlikely to replace the set but they could plug an SMD into it to override the existing operating system. Any profits from advertising that may have been earned by the manufacturer will go to the streaming service provider instead. That could become a major concern for companies that have sold their TVs at or near cost.

Helping consumers understand their options

To compete in this fast-moving market, brands and retailers must find a way to help buyers evaluate their operating system before they invest in a new product. Otherwise, they risk frustrating people if the experience doesn’t meet their expectations. The manufacturer could then miss out on the recurring revenue from advertising, which is significant. Last 2022 in the US, smart TV advertising revenue exceeded $24 billion, which is expected to increase over time.

However, capitalizing on the opportunity may require a new approach. Traditionally, companies have spent significant sums of money on marketing their brand to shoppers. But our survey respondents have put brand at number five on their list of considerations. A large screen, 4K/UHD capability, and energy efficiency were all more important. An OLED display was at number six on their shopping list.

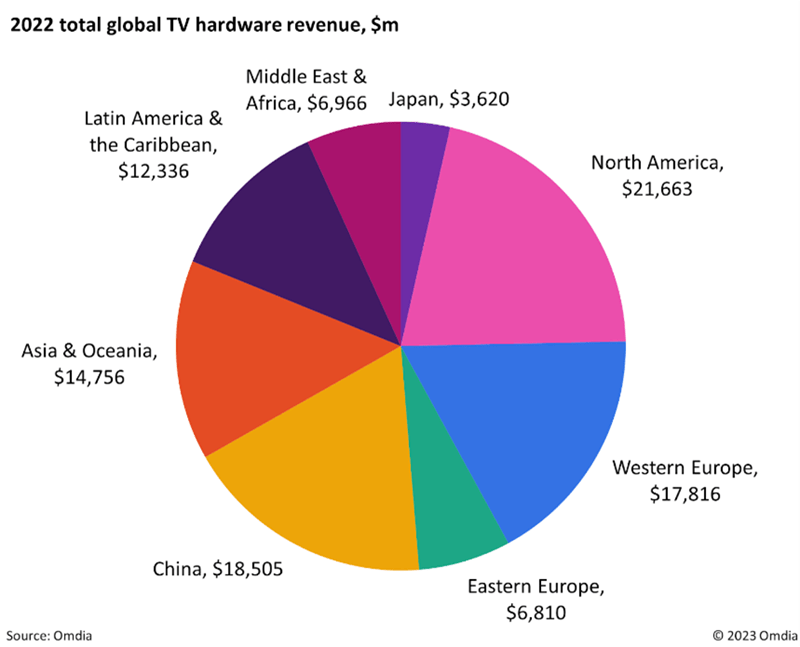

For now, the impact of smart TV advertising is limited to the US and to some extent Latin America and the Caribbean. However, Omdia expects roll outs to reach other regions over the next three years.

If you would like to learn more about these developments and occurring trends, read the first blog in our series, or contact us for further insights and analysis of the challenges and opportunities in the TV industry.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions