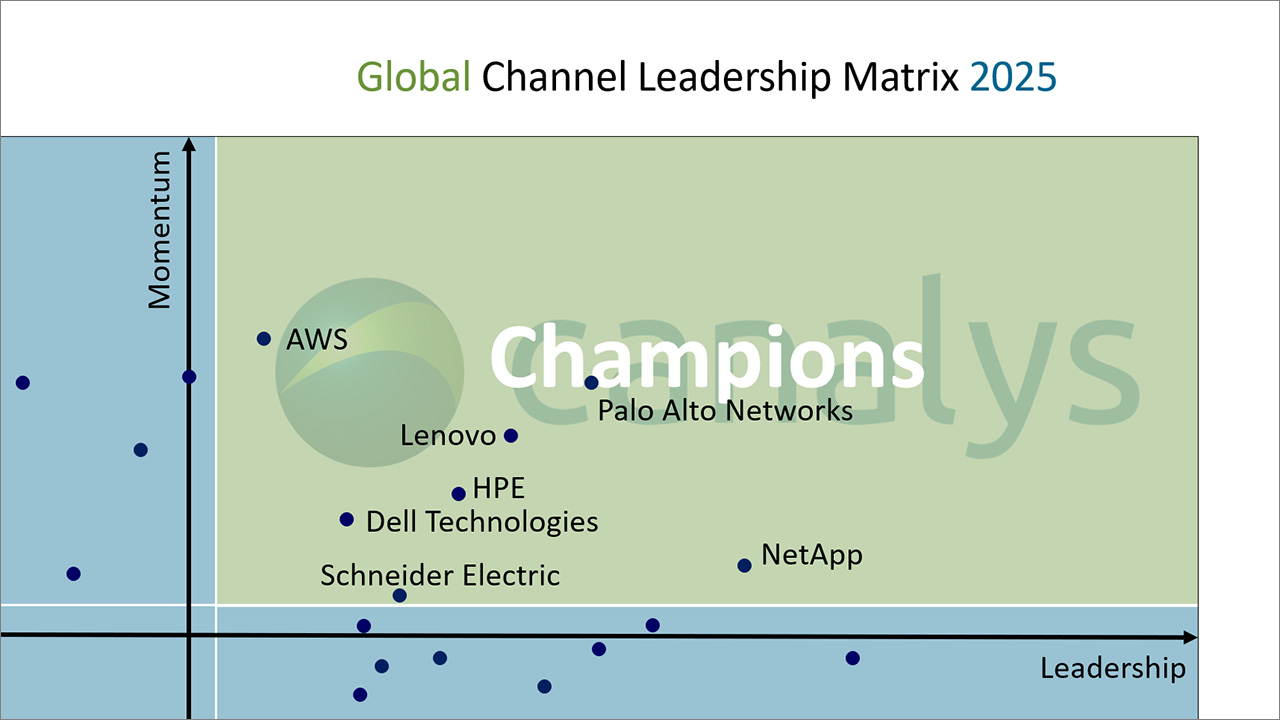

Canalys (now part of Omdia) has published its first Global Channel Leadership Matrix in 2025, consolidating the previously regionally focused APAC, EMEA and North American matrices. The report considered the channel performance of 24 IT vendors across all major technologies and regions meeting minimum revenue and channel share thresholds:

-

Over US$12 billion in global sales with over 25% delivered through partners.

-

Between US$3 and US$12 billion in global sales with over 50% delivered through partners.

There are four categories of vendors in its inaugural Global Channel Leadership Matrix

The objective of the Channel Leadership Matrix is to assess which vendors are playing an integral role in driving the success of the global partner ecosystem across their respective technology areas. It looks at current leadership and future momentum, based on performance over the last 12 months and the ability to execute consistently in the coming year. The seven vendors achieving Champions status showed the highest levels of excellence in channel management compared with their industry peers throughout 2024, while investing in future channel success. These thought and innovation leaders in the channel also demonstrated consistent characteristics, including positive partner sentiment, a commitment to building, enhancing and executing successful partner-led go-to-market models, investments in driving growth opportunities and increasing profitability for partners, and a focus on supporting ecosystem-aligned strategies. Key examples of successful channel-oriented initiatives that Champions rolled out included:

-

Expanding investments in partner co-sell, enablement, incentives, and training and development.

-

Shifting toward or strengthening partner-first approaches, including driving internal sales cultures aligned with a partner-led model, developing best-in-class incentive programs to recognize and reward the value of partners across technology lifecycles, and prioritizing collaboration, co-sell, co-develop, co-marketing and co-deliver strategies.

-

Recognizing, rewarding and enabling more routes to market through more unified approaches to programmatic frameworks.

Other vendors are classified as Contenders, Scalers and Foundations. Contenders have established channel partner strategies and are executing on these strategies but have either yet to capitalize fully on partner opportunities or have seen a decline in partner sentiment and performance in the last 12 months. Scalers are developing their commitment to partner-led models or have seen recent improvements in channel performance but are yet to achieve the highest levels of partner maturity or excellence. Foundation vendors are still developing their partner strategies or have suffered a deterioration in partner sentiment over the last 12 months.

What’s in store for vendors in 2025?

2025 presents a rapidly evolving global IT channel landscape, shaped by economic volatility, geopolitical uncertainty and the accelerated adoption of AI-driven technologies. While inflationary pressures have eased in some regions, customers remain targeted and cautious in their IT investments, prioritizing cost efficiency, automation and security. Cybersecurity remains a top priority as cyber-threats grow in size and sophistication, and customers are increasingly adopting managed detection and response (MDR), zero-trust architectures and AI-driven threat intelligence to strengthen their security. Cloud computing continues to expand, but hybrid and multi-cloud strategies are becoming the norm as enterprises seek greater agility, security, sovereignty and regulatory compliance across diverse global markets. This will help to revitalize hardware replacement cycles as part of complex hybrid IT solutions, particularly as enterprises start to build infrastructure models to support new AI workloads. Networking will be a key growth area in 2025, driven by AI-powered network automation, increased 5G deployments, and enhanced connectivity for edge computing and hybrid work environments.

Now more than ever, enterprises navigating these changes will need to rely on the expertise of partners to advise, integrate, manage and secure increasingly complex IT environments. Vendors that invest in enabling a skilled and collaborative partner ecosystem will be best placed to succeed in 2025. The rapid advance of AI and automation is reshaping the channel, driving demand for AI-integrated business solutions, intelligent automation and data analytics services. Channel partners are adapting by investing in AI expertise, expanding managed services, and leveraging strategic mergers and acquisitions to enhance their capabilities. As vendors refine their partner programs and ecosystems, collaboration is becoming more important than ever to deliver end-to-end solutions that address the complexities of digital transformation in 2025. In this highly complex market environment, partner and channel leadership becomes even harder to achieve and sustain.

Congratulations to AWS, Dell, HPE, Lenovo, NetApp, Palo Alto Networks and Schneider Electric for achieving Champion status in the inaugural Global Channel Leadership Matrix.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions