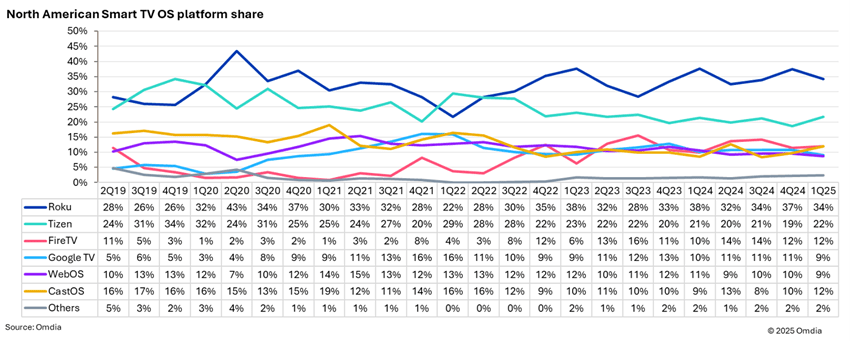

According to Omdia’s latest TV Design & Features Tracker: Pivot – Forecast – 1Q25, Roku has held the leading TV OS unit market share in the US for most of the last six years. In the most recent quarter 1Q25, Roku ranked first at 34% share, Samsung Tizen came in second at 22%, and Amazon FireTV and Vizio CastOS were tied for third place, each with at 12%.

However, new data from Omdia reveals that the US market for smart TV operating systems is about to undergo significant changes in 2025. These changes are being driven by connected TV (CTV)advertising on smart TV operating systems, which is emerging as a subset of retail media networks led by giants like Amazon, Walmart and others. Retail media is an often-overlooked advertising medium that does not receive the same recognition as search engine advertising or social media advertising. Yet this year, the biggest news in advertising didn’t come from Madison Avenue—it came from Bentonville and Seattle. In a span of weeks, Walmart and Amazon made moves that could reshape the future of CTV, advertising, and commerce itself.

Much of this retail media growth is expected to come from advertising budgets being reallocated from traditional linear TV to digital first formats such as CTV. CTVs’ key advantage lies in its ability to use first-part data (retailer prior purchase history and retailer website visits) to target audiences effectively. Retailers, in collaboration with Smart TV OS marketers, can then “close the loop” by tracking which advertising exposures led to a completed purchase whether in store or online. This allows advertisers to test different ads in real time and refine their campaigns based on the effectiveness of demographic segmentation.

Here are the recent headlines making waves:

• Walmart announced it will replace Roku with Vizio’s SmartCast OS on its Onn TVs, effectively ending Roku’s largest OEM partnership. This move positions Walmart to become the #1 TV hardware brand in North America, dethroning Samsung after 19 years.

• Amazon and Roku unveiled a landmark partnership that gives advertisers access to 80 million authenticated U.S. households through Amazon’s demand-side platform (DSP)—the largest logged-in CTV footprint in the country.

• Amazon and Disney also announced a strategic integration, linking Disney’s premium inventory (Disney+, Hulu, ESPN) with Amazon’s commerce insights and DSP capabilities.

These announcements are massive. But what they mean - and how they’ll change the market - is still being digested.

What’s Really Changing?

1. CTV OS Power Shift

Walmart’s move to Vizio OS is more than a hardware swap - it’s a vertical integration play. Walmart now controls the OS, the hardware, and the ad inventory which it can seamlessly integrate into Walmart Connect, its rapidly expanding RMN. This gives Walmart a direct line to the living room—and to billions in ad revenue. For Roku, this is a blow. Walmart’s Onn TVs were a major source of Roku OS installs. Losing this partnership to Vizio means Roku must now rely more heavily on its new Amazon partnership to maintain relevance in the market.

2. Amazon + Roku = Ad Tech Superpower

The Amazon-Roku deal is a game-changer for CTV advertising. Advertisers can now use Amazon DSP to target logged-in users across Roku and Fire TV devices including major streaming apps like Prime Video, The Roku Channel, Disney+, and Tubi. Early tests show 40% more unique reach and 30% less ad repetition, making campaigns more efficient and effective. This marks the first time advertisers can seamlessly target users across multiple CTV platforms with deterministic identity resolution. It’s a major leap toward true performance marketing on TV.

3. The Rise of Shoppable Media

With Amazon and Walmart now owning both the commerce data and the TV screen, the future of shoppable media is coming into focus. Imagine watching a cooking show and instantly buying the ingredients via your remote or seeing a fashion ad and purchasing the outfit directly from your TV. With logged-in users and retail data, both Amazon and Walmart can make this a reality. Disney’s integration with Amazon DSP even hints at contextual commerce, where ad targeting is informed by both content consumption and shopping behavior.

What About Everyone Else?

Smaller CTV OS players like TiVo, Titan, Whale, and The Trade Desk face an uphill battle. Without a massive logged-in user base, retail media infrastructure, or exclusive content partnerships, it’s hard to see how they scale meaningfully in this new landscape.

But there may be a third lane.

Could a Retailer-Led DSP Marketplace Emerge?

Retailers like Best Buy, Target, and Costco could band together to create a neutral DSP marketplace, partnering with TV brands like Samsung, LG, Sony, TCL, or Hisense. This would offer advertisers an alternative to the Amazon-Walmart duopoly leveraging in-store and loyalty data for targeting.

Such a model could provide a more open, brand-safe environment for shoppable media, appealing to brands wary of giving more power to Amazon or Walmart - and to consumers who want more control over their data and ad experiences.

Final Thoughts: The Living Room Is the New Checkout Aisle

The biggest screen in the house is no longer just for watching - it’s becoming a commerce engine. With Amazon and Walmart leading the charge, the convergence of content, commerce, and advertising is accelerating.

The question now isn’t whether shoppable media will happen - it’s who will own it, and how open or closed that ecosystem will be.

Amazon and Walmart are reshaping the CTV landscape through strategic OS and advertising partnerships. Walmart’s integration of Vizio OS into Onn TVs gives it end-to-end control of the CTV stack, while Amazon’s alliance with Roku and Disney creates an unmatched advertising footprint. These moves signal a shift toward shoppable media and performance marketing on the biggest screen in the house.

Smaller players may struggle to compete unless they form alliances or offer unique value. A third lane may emerge if other retailers collaborate to create an open DSP marketplace. The future of CTV will be defined by who controls the data, the ads, and the commerce experience.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions