On 16 May 2025, Charter Communications announced plans to acquire Cox Communications for US$34.5 billion (US$21.9 billion of equity and US$12.6 billion of net debt and finance leases), resulting in Cox Enterprise owning a 23% stake in the new company. The combination will equate to a 37.6 million US customer footprint (31.4 million Charter and 6.3 million Cox). Also, Charter says the merger will offer other benefits such as:

A stronger commercial competitive position against large national telco/cableco brands.

-

Lower bundle prices and an expanded portfolio based on complementary solutions and services, such as:

-

Cox: residential and business Internet, video, voice and mobile connectivity services.

-

Segra: enterprise and carrier fiber provider operating in the Mid-Atlantic and Southeastern United States with more than 40,000 fiber route miles across 24 states.

-

RapidScale: end-to-end managed cloud services provider with more than 2,000 managed cloud customers.

-

Projected US$500 million of annualized transaction cost synergies within three years of the transaction closing.

-

Cox’s customer service jobs returning to the US from overseas to join Charter’s 100% US-based customer service team.

Within a year after closing, the new company will be named Cox Communications, while Spectrum will become the consumer-facing brand for Cox solutions. This isn’t Charter Communications’ first venture into the M&A world. It acquired Time Warner Cable (TWC) and Bright House Network in 2016. The deals were valued at US$67 billion and resulted in Charter becoming the second-largest US cable operator.

US telco and cableco mergers are very common

There have been many US telco and cableco mergers recently, including several in just the last year. AT&T and Lumen Technologies’ Mass Markets business: the acquisition of the Mass Markets fiber-to-the-home business was announced in May 2025 and is expected to close in the first half of 2026. The deal is valued at US$5.75 billion and allows

-

AT&T to expand its fiber network in major metro areas, while Lumen plans to use the sale to increase investments in network expansion for its large enterprise customer base.

-

Verizon Communications and Frontier Communications: the acquisition was announced in 2024 and received Federal Communications Commission (FCC) approval in May 2025. It is valued at US$20 billion and will expand Verizon’s fiber network customers from 7.4 million in nine states to 10 million across 31 states and Washington DC.

-

T-Mobile US and US Cellular: the acquisition was announced in 2024 and is expected to close in mid-2025. The deal is valued at US$4.4 billion and will allow T-Mobile to expand wireless and fixed wireless access, particularly to customers in underserved rural areas.

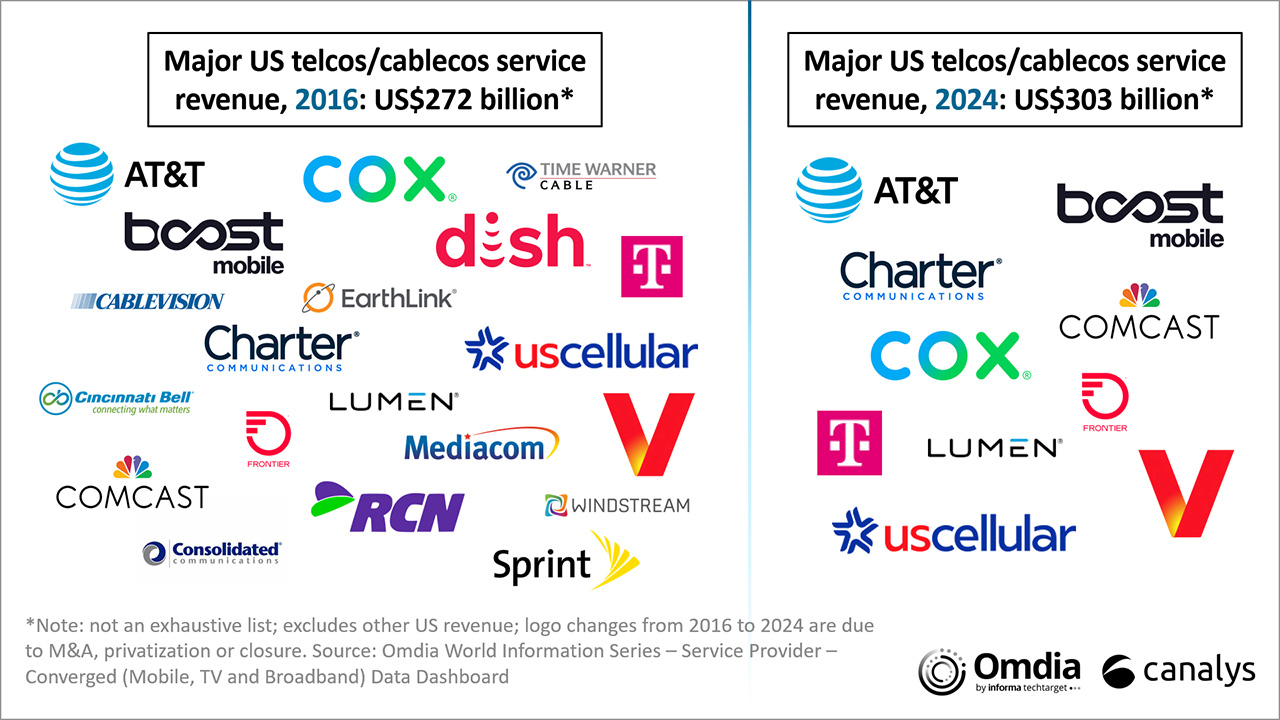

Mergers often lead to reduced competition, with fewer national and regional players, and increased scrutiny from regulators and channel partners alike. Unfortunately, M&As in the US telco/cableco industry are par for the course. In 2016, there were just under 20 major national brands, and in 2024 that number shrank to fewer than 10. During that time, telco services revenue* from the major US brands rose from US$272.3 billion to US$302.9 billion (a 1.2% nine-year CAGR), resulting in average telco services revenue per company rising from US$12.9 billion to US$37.8 billion (a 12.6% nine-year CAGR).

Regulatory and antitrust hurdles

The Charter/Cox deal will likely face strong regulatory scrutiny as the deal closing will reduce the number of major multiple-system operators (MSOs) in the US to two dominant players – Charter and Comcast – resulting in a duopoly and creating concerns about market concentration (especially in underserved and rural markets), pricing and reduced consumer choice. Any regulatory delays could stall integration and combination plans, leaving customers and partners in limbo.

Channel partners prepare for disruption and opportunity

As well as customers’ concerns, channel partners must also be aware of the potential effects of the merger. Charter, Cox Business and RapidScale have good reputations within the channel, based on recent partner feedback obtained by our sister company Channel Futures. Yet managed cloud service provider RapidScale’s status is more pronounced and it is viewed widely as more channel-friendly; it also promotes itself as a 100% channel company and has built a rapport within the technology services distributor (TSD) and technology advisor (TA) communities.

The Charter and Cox channel teams must help partners capitalize on the broader portfolio, which consists of Cox’s cable, Segra’s fiber and RapidScale’s managed cloud solutions, by providing more enablement and support to foster cross- and upselling. Actions partners can proactively take to prepare for the closing of the deal include:

-

Auditing contracts: reviewing current Cox, Segra and RapidScale agreements (commission structures, SLAs and renewal terms) and preparing for renegotiations.

-

Strengthening relationships: increasing communication with current channel managers and engaging early and often with Charter’s channel leaders to stay abreast of potential program changes.

-

Diversifying portfolios: Exploring alternative cable, fiber and managed cloud services suppliers to keep options open and avoid being over-reliant on a single provider.

-

Educating customers: notifying clients of potential changes in service, billing or support so they can plan accordingly, which they will appreciate from a trusted advisor.

-

Capitalizing on new capabilities: training teams on new service additions, such as RapidScale’s cloud or Segra’s fiber, and building bundled solutions that leverage the expanded portfolio.

Conclusion

The proposed Charter/Cox merger is a pivotal moment for the US channel ecosystem. Partners must prepare now by protecting their interests and positioning themselves to capitalize on new opportunities within the consolidated telco/cableco landscape. *Note: services revenue excludes “Other”: US$33.6 billion in 2016 and US$45.6 billion in 2024.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions