Netflix and Amazon are testing an enticing theory: that millions of consumers who don't own games consoles will embrace TV gaming. The streaming giants aim to bypass what they perceive as traditional barriers - expensive hardware, complex gameplay, and premium pricing - by offering simple "party" games controlled via smartphones, effectively free to hundreds of millions of their existing subscribers.

The Thanksgiving and Christmas holiday periods will provide the first meaningful tests of consumer appetite for their strategies, although expectations should remain modest. The platforms face the challenge of competing against established gaming alternatives and their own core video offerings—a dynamic that may ultimately constrain adoption regardless of quality or execution.

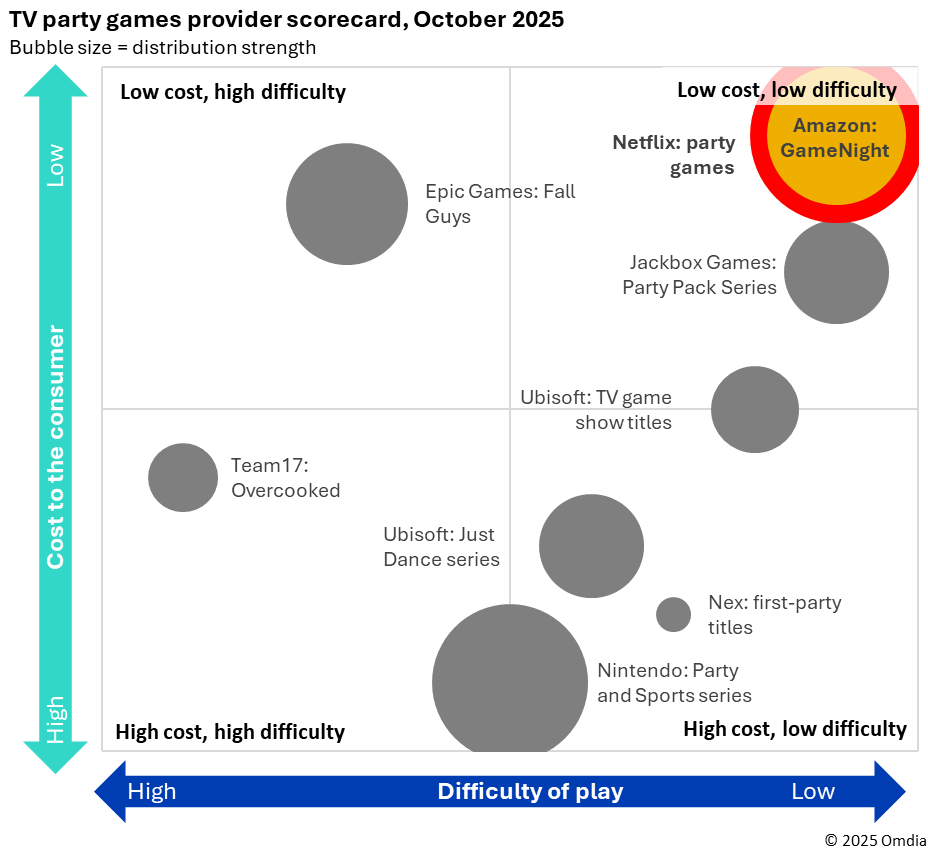

Similar strategies - but with crucial differences

If Amazon and Netflix are correct, the market could be huge. About 25-40% of adults in major developed and developing markets say they regularly play games on their smartphones, tablets, or PCs, but do not own consoles, according to survey data from Omdia's Consumer Research Spotlight. Worldwide, this addressable audience for Netflix and Amazon's take on TV gaming could run into the hundreds of millions, and potentially billions if they can convince non-gamers to play.

While Amazon and Netflix both believe in this potentially huge, untapped audience for TV gaming, they are taking slightly different approaches. Netflix is adding games directly to its main online video app as just another form of entertainment alongside movies and TV shows. Amazon's party games will sit in a dedicated GameNight-branded section of its Luna cloud gaming service, alongside more traditional console-style games.

Amazon and Netflix have also taken markedly different approaches to using smartphones to control games. Amazon's GameNight titles use browser-based controls accessed via QR codes, meaning users do not need to download a separate app. Netflix, by contrast, requires users to download a dedicated Netflix Game Controller app that promises more sophisticated features.

Netflix's and Amazon's plans have huge potential - in theory

The largest TV gaming platforms in history?

With over 300 million subscriptions, Netflix's reach far exceeds any games console, cloud gaming service, or connected TV operating system. Amazon Prime subscriptions number 200 million, but the need to access its TV games through the Luna app will create friction, limiting its adoption.

A "free and easy" gap in the TV gaming market

While using cloud gaming technology to deliver games via smart TV apps is not new, offering services effectively for free targets a significant barrier to adoption. Data from Omdia's Consumer Research Spotlight service shows 70% of gamers in major markets prefer free experiences, while only 12% want subscriptions.

Discovery engines that gaming companies can only dream of

Netflix can surface games alongside movies and TV shows; Amazon can promote Luna's games through Prime Video and Twitch. Netflix's advantage is particularly powerful: about half of Netflix users watch the service every day, with most others watching at least once a week. This phenomenal level of engagement presents a major window to promote games to gamers and non-gamers alike.

The potential for genuinely new gaming experiences

Amazon's Courtroom Chaos: Starring Snoop Dogg uses speech recognition and generative AI (GenAI) to enable players to act as plaintiffs, defendants, and witnesses in court cases that can take an infinite number of variations. Both companies' smartphone-controller approach has the potential to harness technology in devices that every user already carries, laying the ground for Nintendo Wii-like innovation in motion-controlled party games without the need to spend hundreds of dollars on consoles and controllers.

Both strategies will face major limitations in practice

Availability will fall well short of Netflix's and Amazon's ubiquity

Netflix's TV games are currently in beta for a subset of users, with a limited range of smart TVs in selected countries. Amazon's Luna app is available only in certain countries and via newer models of Samsung and LG smart TVs and Fire TV devices. Given that consumers tend to replace their TVs only every 7-9 years, the addressable market for the streamers' TV games may grow slowly unless they strike more partnerships with vendors.

Compromises for lowest-common-denominator devices

Netflix's and Amazon's target audience of families and casual users will likely expect the same seamless "press play and it works" experience they get from video streaming. The smartphone-as-controller approach, however, introduces numerous points of potential failure. Nearly half of App Store reviewers of the Netflix Game Controller app give it one star, mostly complaining about setup problems, according to Omdia analysis of Sensor Tower data.

Barriers to securing great games for subscription services

Unlike many media markets, games revenue comes overwhelmingly from one-off purchases rather than subscriptions. Omdia forecasts that subscriptions will account for just 10% of games revenue in five years' time, compared to about 70% for online video and music. As a result, publishers and studios may be reluctant to license or develop titles for subscription services that could generate more ongoing revenue on the open market.

The reputational risks of real-time AI in gaming

Amazon's GenAI-assisted gaming represents uncharted territory for a major brand. While 81% of US consumers surveyed by Omdia last year said the use of AI in games was acceptable, AI apps that enable similar role-playing to Courtroom Chaos have faced controversies related to sexual content, misinformation, and harmful advice. For Amazon's Luna service, maintaining its family-friendly positioning will require closely defined gaming experiences.

"Free" does not guarantee adoption

Netflix's mobile games generated just 0.5% uplift in time spent after four years in operation, according to Omdia analysis, while many Amazon "free" services within Prime bundles see limited uptake. Questions remain around the actual number of households that will embrace TV party gaming, especially when Nintendo may have already secured a significant share and be set to capture even more as consumers buy the new Switch 2.

Competing with the power of binge-viewing

Perhaps the biggest obstacle is internal competition. Netflix users expect "lean-back" passive experiences, not "lean-in" active ones. Party games require families to muster the time, energy, and collective will to play, rather than just watch TV. Both platforms must convince households to choose gaming over their everyday entertainment habits - a particularly difficult sell when binge-watching requires less coordination and effort.

Will the juice will be worth the squeeze of the lemon?

The "effectively free to subscribers" positioning of both strategies appears to acknowledge that games will not meaningfully attract new subscribers to their core subscription offerings. We also stand by our earlier prediction that the relatively modest nature of Netflix's overall games strategy will not contribute more than a single-digit increase to its "North Star" metric, time spent.

The holidays will create new learnings, not new habits

If there is any time when Netflix's and Amazon's TV gaming strategies will cut through, it is during Thanksgiving and Christmas. The playing of both board games and party-style video games is highly concentrated around holiday seasons, as families seek group activities.

However, the TV party game concept will also face its ultimate test: whether unusually time-rich families will choose communal gaming experiences over the personalized, binge-watching behavior that Netflix and Amazon have cultivated among their subscribers. As a result, the holiday season will be more about learning what might stick than making any major breakthroughs, especially once vacations end and subscribers return to their daily routines.

We recommend developers and publishers explore how they can derive new revenue streams by licensing or developing TV party games for the tech giants, given the saturation of the overall games market - and the huge size of Netflix and Amazon's content budgets. But as with the tech giants' previous forays into gaming, Omdia advises rival streamers and games platforms to watch closely but not rush to follow.

This blog is an abridged version of the Omdia report Assessing Netflix’s and Amazon’s TV Gaming Strategies. Clients can access the report here: https://omdia.tech.informa.com/om139100/assessing-the-outlook-for-netflixs-and-amazons-tv-gaming-strategies

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions