LONDON, 2 March, 2023 – The semiconductor market reached an all-time high in 2022, with total revenue hitting $595.7B, just surpassing 2021’s record revenue of $592.8B. But the semiconductor market has declined for four straight quarters making it feel anything but a record year in its current state according to the latest research from Omdia. 4Q22 shrank 9% from the previous quarter, the biggest decline in the current downturn. 4Q22 revenue of $132.4B is just 82% of the record quarterly revenue of $161.1 in 4Q21.

In 2021, all major application groups increased revenue by double-digit growth rates, from 11% growth for wired communications to 36% growth for semiconductors in consumer electronics. The record revenue in 2022 was mixed with the highpoint being the automotive semiconductor market up 21% year over year (YoY). At the other end was the data processing segment, which declined 6% YoY as demand weakened for PCs and other applications.

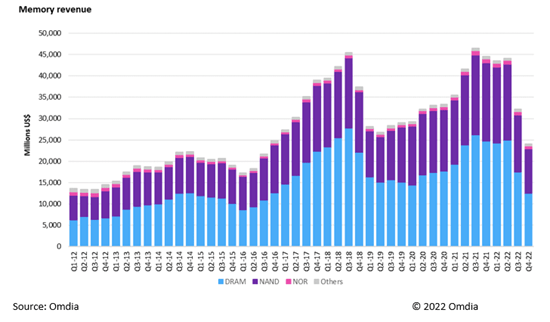

The memory market has suffered the most in the current downturn with it reaching a record $46.5B in 3Q21. 4Q22 was just 52% of that number, bringing in just $24.1B.

DRAM Senior Principal Analyst Lino Jeng comments, “The sharp decline in sales in the memory market is attributable to the following three reasons. One, a rapid decrease in IT demand that occurred with the end of COVID19. Two, excess inventory due to record-high investments by memory makers at the demand inflection point. Three, macro economy contraction and IT demand slowdown due to interest rate hikes by central banks of each country. In particular, the fourth quarter of 2022, prices fell significantly due to suppliers' attempts to expand sales to reduce excess inventory. Omdia expects this trend to continue in the first quarter of this year.”

The top two semiconductor companies by revenue kept spots in the top two, but their combined revenue was nearly $24B lower than 2021. SK Hynix and Micron, memory companies, both slipped one spot, allowing Qualcomm and Broadcom to both rise one spot each in the top five. AMD rose the most spots, up three from 2021 mainly due to their acquisition of Xilinx, which added nearly $5B in revenue.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions