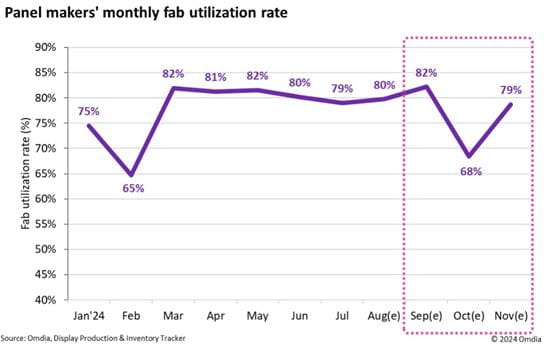

LONDON, September 12, 2024: Display panel makers forecast are set to make severe cuts to their fab utilization in October 2024, according to Omdia’s Display Production and Inventory Tracker. The latest report revealed that panel makers' overall fab utilization forecasts will drop by 14 percentage points month-on-month (MoM) to 68% in October. The fab utilization cut forecasts will be led by China’s major LCD makers as they plan to halt LCD TV panel production during the National Day holiday for one to two weeks.

During the production control, the combined monthly average utilization rate for China’s top three panel makers’ BOE, China Star, and HKC Display, is forecast to fall to 61% in October 2024. Due to their large market share, the fab utilization rate control by these companies significantly impacts the overall LCD TV panel market. In 1H 2024, these three panel makers held a combined share by area exceeding 60% in the LCD TV panel market . Meanwhile, other panel makers have maintained a more stable monthly average utilization rate, ranging between 75% and 82% in 2024.

Chinese major panel makers are planning to adjust their production to counter the declining LCD TV panel prices which are expected to drop every month until the mid-fourth quarter. These panel makers expect the production control will either halt or mitigate the price fall.

Panel makers are also prepared to adjust inventory levels by reducing utilization rates, as TV set makers are expected to refrain from aggressive year-end marketing promotion later this year due to rising costs such as LCD TV panel prices, and weaker-than-expected TV sales during China’s 618 promotions and global sports events.

Alex Kang, Principal Analyst in Omdia’s Display research practice, said "Panel makers were able to lift panel prices after reducing their utilization rate to 56% in February 2024, and continue to follow production-to-order strategies, where panels are produced only after receiving confirmed customer orders. Even after the fab utilization cut in October, there is a high possibility that panel makers will implement significant production control when panel prices are set to drop, or inventories are about to rise.

"Some panel makers are already considering repeating the utilization cut during the next year’s Lunar New Year holiday," concluded Kang.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions