LONDON, March 26, 2025: The network security market grew 5.1% year-over-year (YoY) in Q4 2024 and 3.1% for the full year according to Omdia’s market estimates and forecast through to 2029. Palo Alto Networks retained its position as the market leader with a 28.4% share in 2024, driven by steady demand for security appliances and higher adoption of software and SASE components.

Omdia’s report covers key segments of the network security market including integrated security appliances, secure routers, SSL VPN gateways, VPN and firewall software, and network based IDS/IPS.

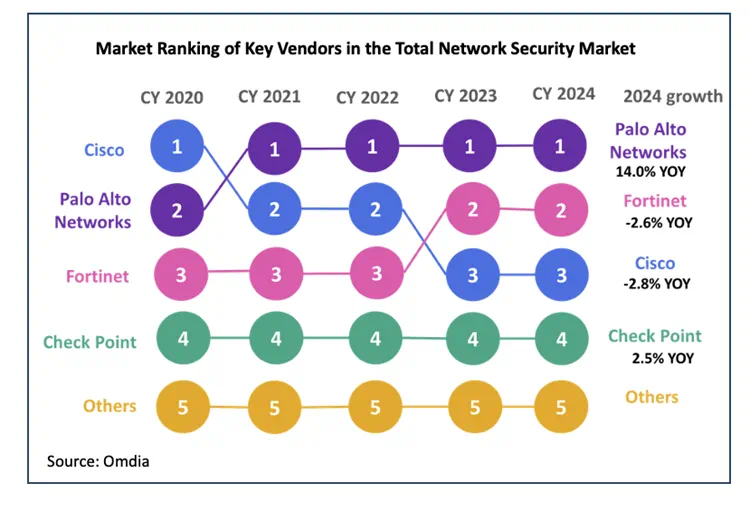

“Palo Alto Networks, Fortinet, Cisco and Check Point continue to lead the network security market with each holding double digit share consecutively for the last five years,” said Ketaki Borade, Omdia Senior Analyst, Infrastructure Security. “The growing adoption of SASE architecture is the driving force behind network security growth accelerating software integrations. As the threat landscape evolves, next generation firewalls must integrate seamlessly with other security solutions. AI and machine learning (ML) will continue to play a critical role in enabling a more predictive and proactive security approach.”

Rik Turner, Omdia Senior Principal Analyst, Cybersecurity added: “The dominance of the top four firewall vendors is not only a clear sign that this is a mature market, but also an indication that, if they strategically position themselves well in the still early-stage SASE market, they have the potential to strengthen their grip on network security for years to come. Two of the four (Check Point and Cisco) have shifted away from internal cloud-native security (CNAPP) development, opting instead to OEM/white-label Wiz’s product.

This highlights a deliberate choice of where to compete against market leader Palo Alto Networks. Their focus on SASE aligns with their firewall expertise and the rapid expansion of SaaS usage in enterprises.”

The chart illustrates the market ranking of key vendors for the total network security market for last five years. Palo Alto has retained the top position since 2021 due to its platformization strategy which emphasizes AI-driven product integration. Meanwhile, Cisco has climbed to third place while Fortinet’s targeted approach of secure networking, unified SASE and security operations has helped it to reach second place. With 25% of its FortiGate devices due for refresh, Fortinet may see a revenue surge over the next two years.

Several factors may be contributing to this cautious outlook including enterprise cost-cutting, prioritization of essential services and a shift to cloud and SASE solutions. This transition is likely to impact demand for traditional hardware firewalls while software firewalls and firewall-as-a-platform gain traction.

Overall, Omdia forecasts a 2.8% CAGR for the total network security market from 2024 and 2029 with firewall growth projected at 5.0% CAGR over the same period.

“While the market remains growth, increased product integration and SASE adoption will continue to shape its evolution,” concludes Borade.

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions