In this blog, Omdia’s Patrick Horner, explores the recent tariff changes imposed by President Trump and how these measures could affect the consumer electronics market, particularly in the television industry. We examine how manufacturers and retailers might respond to these tariffs, including potential shifts in supply chains and inventory strategies, and the long-term feasibility of relocating TV assembly operations to countries with tariff-free access.

On January 20, 2025, President Trump signed an executive order imposing a 25% tariff on imports from Mexico and Canada, effective February 1, 2025. Additionally, he announced plans to implement a 10% tariff on Chinese imports which began on February 4. These measures are part of the administration's "America First" trade policy, which aims to encourage domestic manufacturing and address trade imbalances. However, such tariffs could lead to higher consumer prices, supply chain disruptions, and potential retaliatory actions from the affected countries.

The challenge with formulating a response to these tariff changes lies in the uncertainty surrounding President’s approach. His negotiating style is often characterized by unexpected statements which can make it difficult for businesses to anticipate the direction of policy shifts and develop definitive strategies.

Tariff impact on the TV industry

One of the sectors most impacted by these tariffs in consumer electronics market specifically the television industry. Many televisions are manufactured or assembled in the affected countries, meaning these tariffs are likely to increase the cost of televisions in the US market. Retailers including major players like Walmart are already expressing caution.

Despite reporting a 4.1% increase in sales to $180.55 billion for the quarter ending January 31, 2025, Walmart anticipates potential challenges ahead. The company has forecast earnings per share could be up to 27 cents below analyst expectations citing rising costs and the uncertainty around the newly imposed tariffs. Their sales projectionof 3% to 4%, falls short of analyst expectations, indicating that the increased costs from tariffs could affect consumer purchasing power.

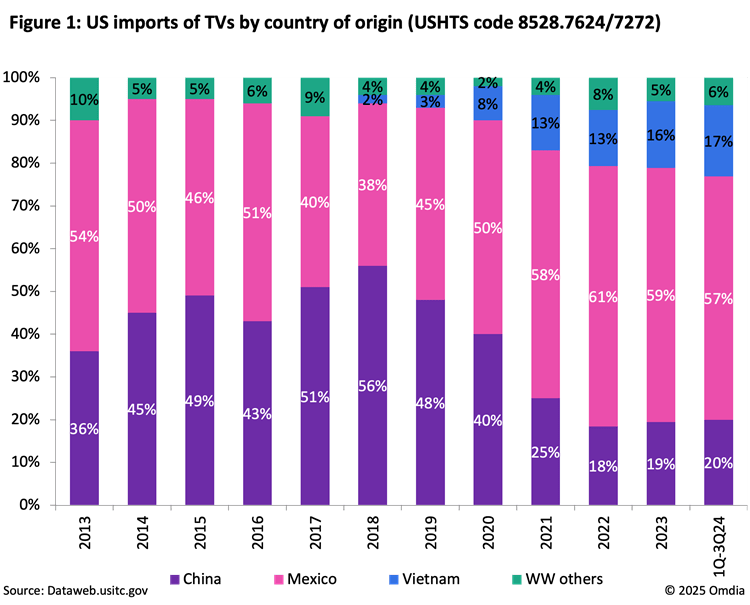

Inventory strategies will be affected by these uncertainties. . Inventory rose 2.8%, hinting at cautious ordering ahead of potential tariffs.These tariffs have the potential to increase the cost of imported televisions and components, prompting retailers to reassess their inventory holdings. Retailers must decide whether to increase their inventory in anticipation of rising costs or diversify their supply chains to source products from countries not affected by the tariffs. In recent years, the shift in US TV imports has been dramatic. As of 2024, the proportion of US TV imports from China has dropped significantly, from 56% in 2018 to just 20% illustrated in Figure 1. This shift is largely due to the imposition of tariffs that made Chinese imports less competitive, with Mexico and to a lesser extent Vietnam picking up the slack.

Relocating TV assembly operations

If new tariffs are imposed on TVs from Mexico, manufacturers may consider relocating assembly to tariff-free countries. The feasibility depends on a range of factors such as supply chain logistics, factory capacity, labor costs, and regulatory challenges.

For manufacturers with existing factories in in tariff-free countries, shifting partial production could take between six and 12 months. However, building a new greenfield factory could take anywhere from two to three years. Estimated costs for relocation of a TV assembly factory are lower if shifting to an existing facility in a tariff-free country than building a new factory from the ground up.

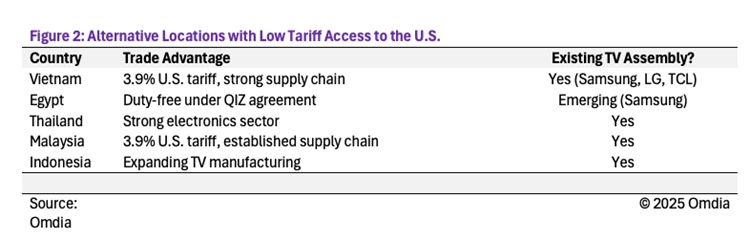

As shown in Figure 2: Vietnam stands out as the most viable alternative due to its existing TV production infrastructure. Egypt offers potential advantages due to duty-free access under the Qualifying Industrial Zones (QIZ) agreement. This program allows Egyptian goods to enter the U.S. tariff-free even though the US and Egypt do not have a bilateral free trade agreement. The Generalized System of Preferences (GSP) another U.S. trade initiative allows eligible products from developing countries, including Egypt, to enter duty-free.

However, relocating assembly operations to these countries are not without its challenges. While labor costs in Vietnam and Egypt may be lower than Mexico, logistics costs could be higher. Additionally, even if assembly operations are moved, the risk of supply chain disruptions remain significant, as many TV components still come from China. If tariffs are temporary, a billion-dollar TV assembly factory relocation investment may not be justifiable.

Is relocation worth the investment?

For manufacturers, the decision to relocate production may hinge on the duration of the tariffs. In the short-term, companies may absorb tariffs or pass those costs on to consumers. In the mid-term (1-2 years), diversifying production to countries like Vietnam, Egypt, or Thailand could mitigate tariff risks and reduce the impact of tariffs. In the long-term (3+ Years), if tariffs remain high, a more significant shift in production to Southeast Asia or tariff-exempt nations is likely.

More from author

More insights

Assess the marketplace with our extensive insights collection.

More insightsHear from analysts

When you partner with Omdia, you gain access to our highly rated Ask An Analyst service.

Hear from analystsOmdia Newsroom

Read the latest press releases from Omdia.

Omdia NewsroomSolutions

Leverage unique access to market leading analysts and profit from their deep industry expertise.

Solutions